Question: Problem 3.3. A trader holds a derivative whose value depends on the price of a stock. To manage this risk, the trader takes positions (long

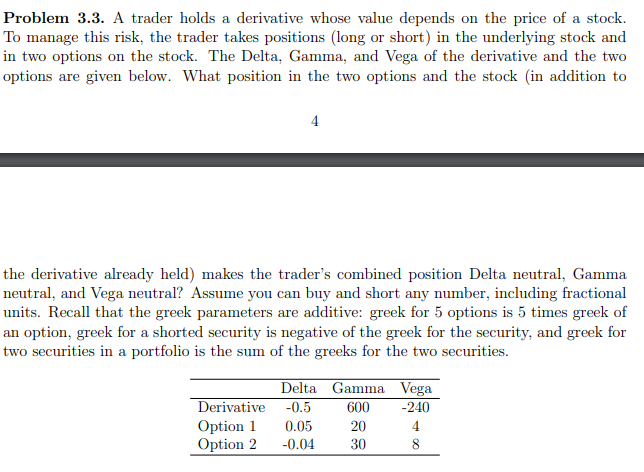

Problem 3.3. A trader holds a derivative whose value depends on the price of a stock. To manage this risk, the trader takes positions (long or short) in the underlying stock and in two options on the stock. The Delta, Gamma, and Vega of the derivative and the two options are given below. What position in the two options and the stock (in addition to 4 the derivative already held) makes the trader's combined position Delta neutral, Gamma neutral, and Vega neutral? Assume you can buy and short any number, including fractional units. Recall that the greek parameters are additive: greek for 5 options is 5 times greek of an option, greek for a shorted security is negative of the greek for the security, and greek for two securities in a portfolio is the sum of the greeks for the two securities. Derivative Option 1 Option 2 Delta Gamma Vega -0.5 600 -240 0.05 20 4 -0.04 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts