Question: Problem 3-32 Calculating the Times Interest Earned Ratio (LO 2] For the most recent year, Camargo, Inc., had sales of $542,000, cost of goods sold

![Problem 3-32 Calculating the Times Interest Earned Ratio (LO 2] For](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e99e2e74f9a_41366e99e2db0971.jpg)

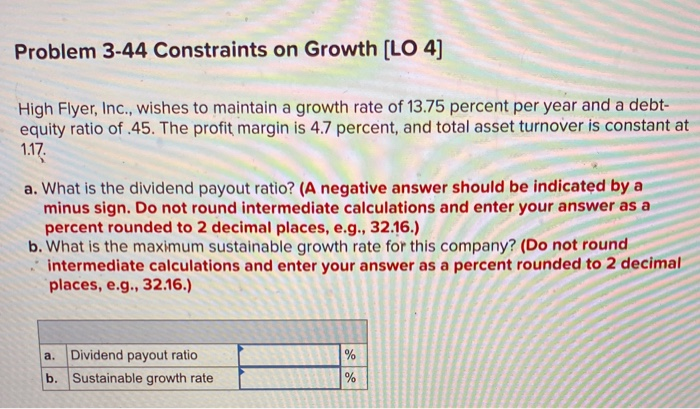

Problem 3-32 Calculating the Times Interest Earned Ratio (LO 2] For the most recent year, Camargo, Inc., had sales of $542,000, cost of goods sold of $243,500, depreciation expense of $61,400, and additions to retained earnings of $73,800. The firm currently has 21,000 shares of common stock outstanding and the previous year's dividends per share were $1.20. Assuming a 22 percent income tax rate, what was the times interest earned ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Times interest earned times Problem 3-44 Constraints on Growth [LO 4] High Flyer, Inc., wishes to maintain a growth rate of 13.75 percent per year and a debt- equity ratio of .45. The profit margin is 4.7 percent, and total asset turnover is constant at 1.17 a. What is the dividend payout ratio? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the maximum sustainable growth rate for this company? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Dividend payout ratio b. Sustainable growth rate % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts