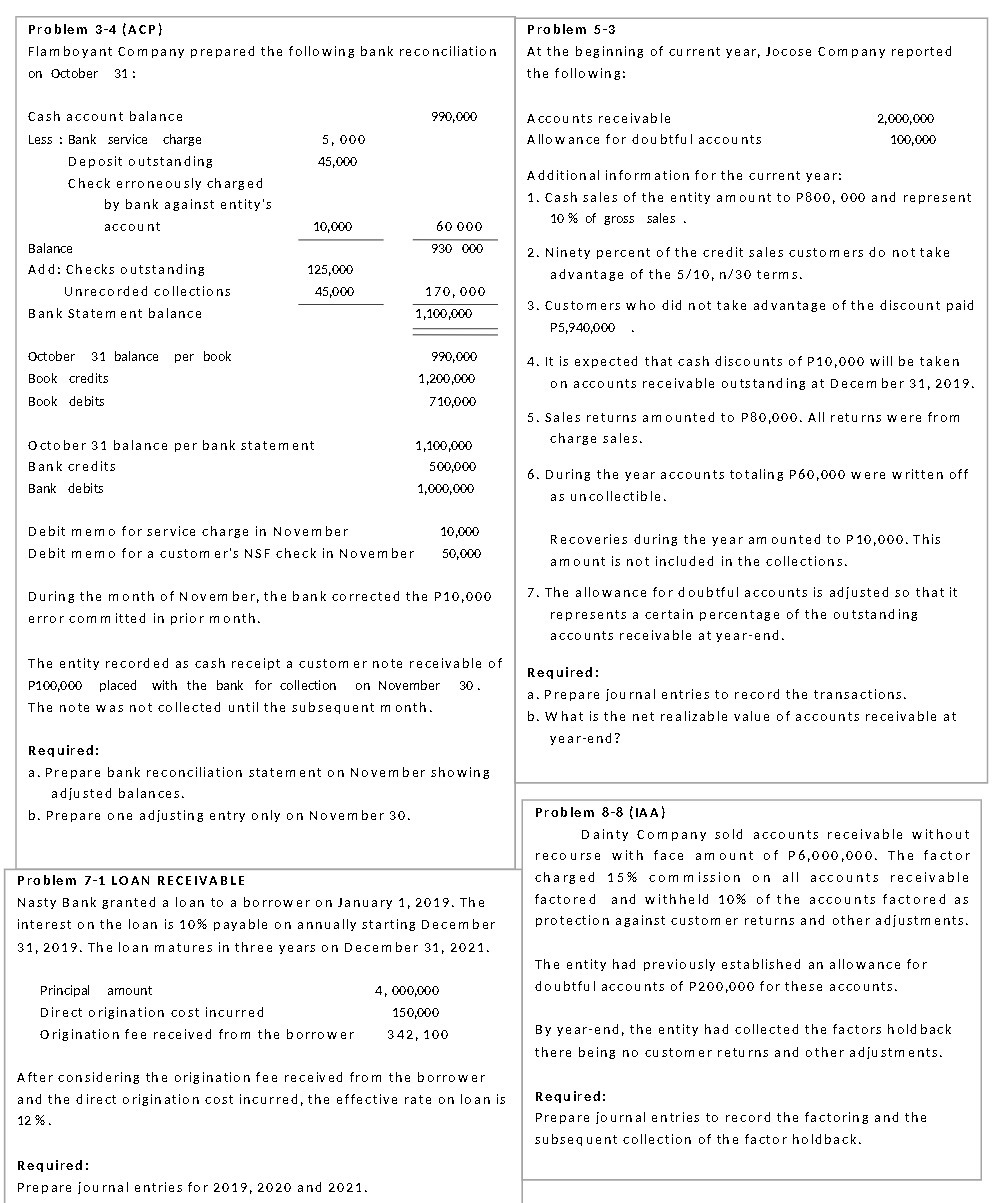

Question: Problem 3-4 (ACP ) Problem 5-3 Flamboyant Company prepared the following bank reconciliation At the beginning of current year, Jocose Company reported on October 31

Problem 3-4 (ACP ) Problem 5-3 Flamboyant Company prepared the following bank reconciliation At the beginning of current year, Jocose Company reported on October 31 : the following: Cash account balance 990,000 Accounts receivable 2,000,000 Less : Bank service charge 5, 000 Allowance for doubtful accounts 100,000 Deposit outstanding 45,000 Check erroneously charged Additional information for the current year: by bank against entity's 1. Cash sales of the entity amount to P800, 000 and represent account 10,000 60 000 10% of gross sales . Balance 930 000 2. Ninety percent of the credit sales customers do not take Add: Checks outstanding 125,000 advantage of the 5/10, n/30 terms. Unrecorded collections 45,000 170, 000 Bank Statement balance 1,100,000 3. Customers who did not take advantage of the discount paid P5,940,000 October 31 balance per book 990,000 4. It is expected that cash discounts of P10,000 will be taken Book credits 1,200,000 on accounts receivable outstanding at December 31, 2019. Book debits 710,000 5. Sales returns amounted to P80,000. All returns were from October 31 balance per bank statement 1,100,000 charge sales. Bank credits 500,000 6. During the year accounts totaling P60,000 were written off Bank debits 1,000,000 as uncollectible. Debit memo for service charge in November 10,000 Recoveries during the year amounted to P10,000. This Debit memo for a customer's NSF check in November 50,000 amount is not included in the collections. During the month of November, the bank corrected the P10,000 7. The allowance for doubtful accounts is adjusted so that it error committed in prior month. represents a certain percentage of the outstanding accounts receivable at year-end. The entity recorded as cash receipt a customer note receivable of Required: P100,000 placed with the bank for collection on November 30 . a. Prepare journal entries to record the transactions. The note was not collected until the subsequent month. b. What is the net realizable value of accounts receivable at year-end? Required: a. Prepare bank reconciliation statement on November showing adjusted balances. b. Prepare one adjusting entry only on November 30. Problem 8-8 (IAA) Dainty Company sold accounts receivable without recourse with face amount of P6,000,000. The factor Problem 7-1 LOAN RECEIVABLE charged 15% commission on all accounts receivable Nasty Bank granted a loan to a borrower on January 1, 2019. The factored and withheld 10% of the accounts factored as interest on the loan is 10% payable on annually starting December protection against custom er returns and other adjustments. 31, 2019. The loan matures in three years on December 31, 2021. The entity had previously established an allowance for Principal amount 4, 000,000 doubtful accounts of P200,000 for these accounts. Direct origination cost incurred 150,000 Origination fee received from the borrower 342, 100 By year-end, the entity had collected the factors hold back there being no customer returns and other adjustments. After considering the origination fee received from the borrower and the direct origination cost incurred, the effective rate on loan is Required: 12 % . Prepare journal entries to record the factoring and the subsequent collection of the factor holdback. Required: Prepare journal entries for 2019, 2020 and 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts