Question: Problem 35 You have until 3:52 PM to complete this assignment. Part 1 | Attempt 1/2 for 10 pts. Village bank has 9-year zero coupon

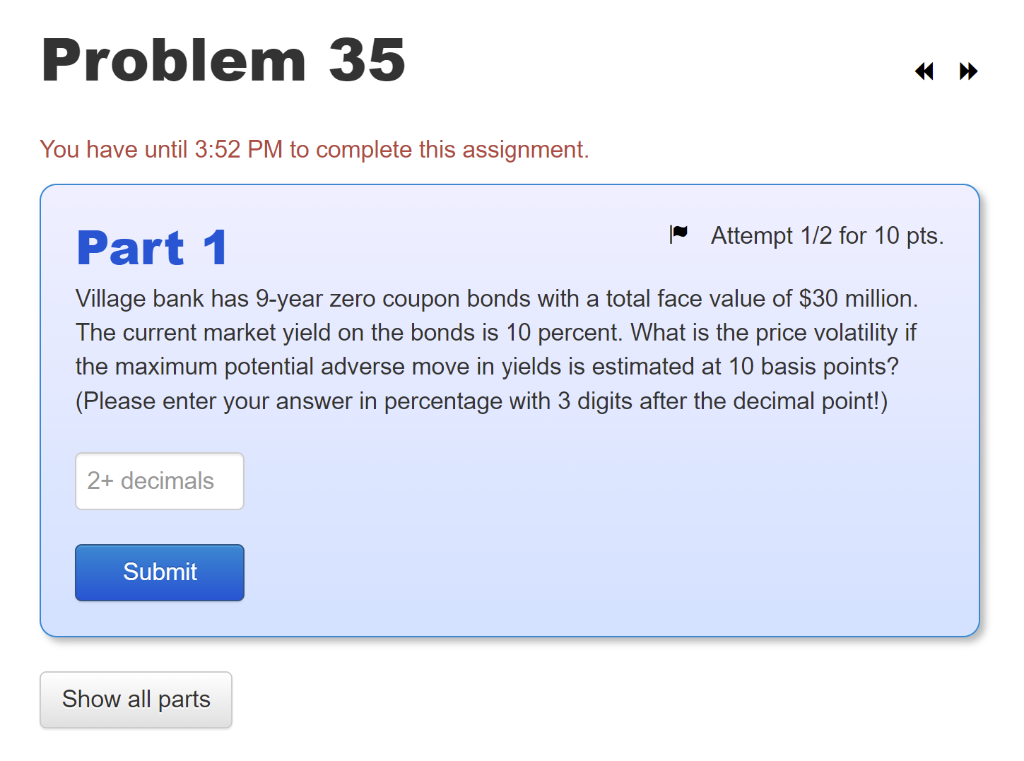

Problem 35 You have until 3:52 PM to complete this assignment. Part 1 | Attempt 1/2 for 10 pts. Village bank has 9-year zero coupon bonds with a total face value of $30 million. The current market yield on the bonds is 10 percent. What is the price volatility if the maximum potential adverse move in yields is estimated at 10 basis points? (Please enter your answer in percentage with 3 digits after the decimal point!) 2+ decimals Submit Show all parts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts