Question: Problem 3-6 Fred Klein started his own business recently. He began by depositing $5,000 of his own money (equity) in a business account. Once he'd

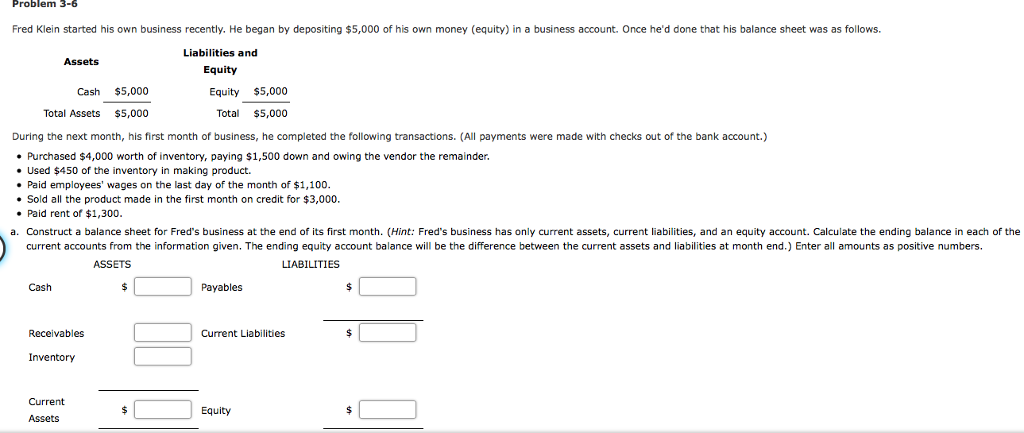

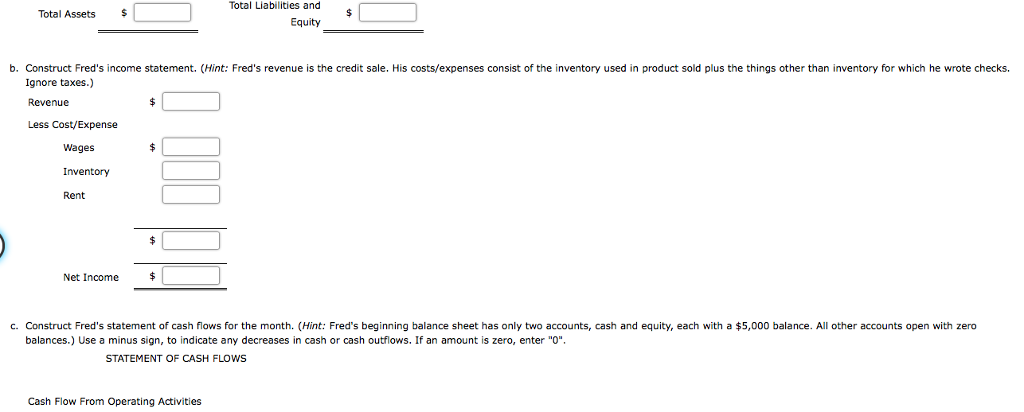

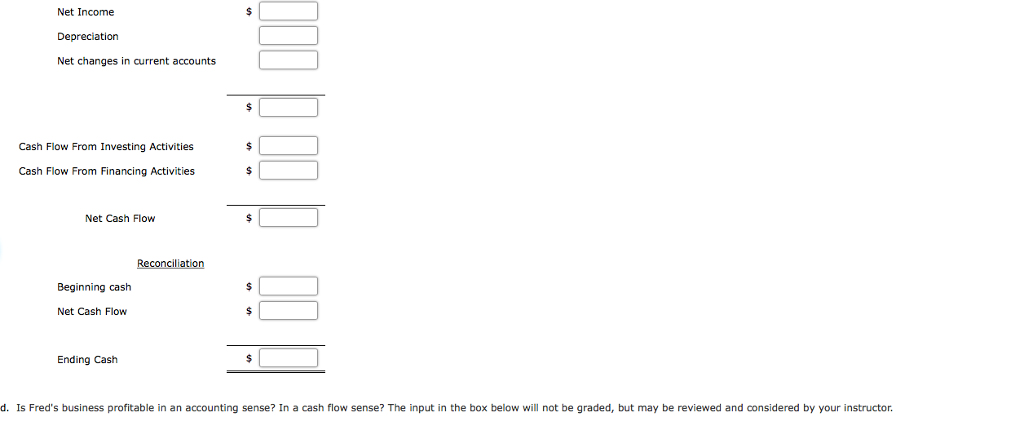

Problem 3-6 Fred Klein started his own business recently. He began by depositing $5,000 of his own money (equity) in a business account. Once he'd done that his balance sheet was as follows. Liabilities and Assets Equity Cash $5,000 Equity $5,000 Total Assets $5,000 Total $5,000 During the next month, his first month of business, he completed the following transactions. (All payments were made with checks out of the bank account.) Purchased $4,000 worth of inventory, paying $1,500 down and owing the vendor the remainder . Used $450 of the inventory in making product. . Paid employees' wages on the last day of the month of $1,100 Sold all the product made in the first month on credit for $3,000 Paid rent of $1,300 a. Construct a balance sheet for Fred's business at the end of its first month. (Hint: Fred's business has only current assets, current liabilities, and an equity account. Calculate the ending balance in each of the current accounts from the information given. The ending equity account balance will be the difference between the current assets and liabilities at month end.) Enter all amounts as positive numbers. ASSETS LIABILITIES Cash Payables Receivables Current Liabilities Current Equity Assets Total Liabilities and Total Assets Equity b. Construct Fred's income statement. (Hint: Fred's revenue is the credit sale. His costs/expenses consist of the inventory used in product sold plus the things other than inventory for which he wrote checks. Ignore taxes.) Revenue Less Cost/Expense Wages Inventory Rent Net Income c. Construct Fred's statement of cash flows for the month. (Hint: Fred's beginning balance sheet has only two accounts, cash and equity, each with a $5,000 balance. All other accounts open with zero balances.) Use a minus sign, to indicate any decreases in cash or cash outflows. If an amount is zero, enter "O" STATEMENT OF CASH FLOWS Cash Flow From Operating Activities Net Income Depreciation Net changes in current accounts Cash Flow From Investing Activities Cash Flow From Financing Activities Net Cash Flow Reconciliation Beginning cash Net Cash Flow Ending Cash d. Is Fred's business profitable in an accounting sense? In a cash flow sense? The input in the box below will not be graded, but may be reviewed and considered by your instructor e. Can the business fail while making a profit? How might that happen in the next month or so? The input in the box below will not be graded, but may be reviewed and considered by your instructor. Check My Work 2 more Check My Work uses remaining Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts