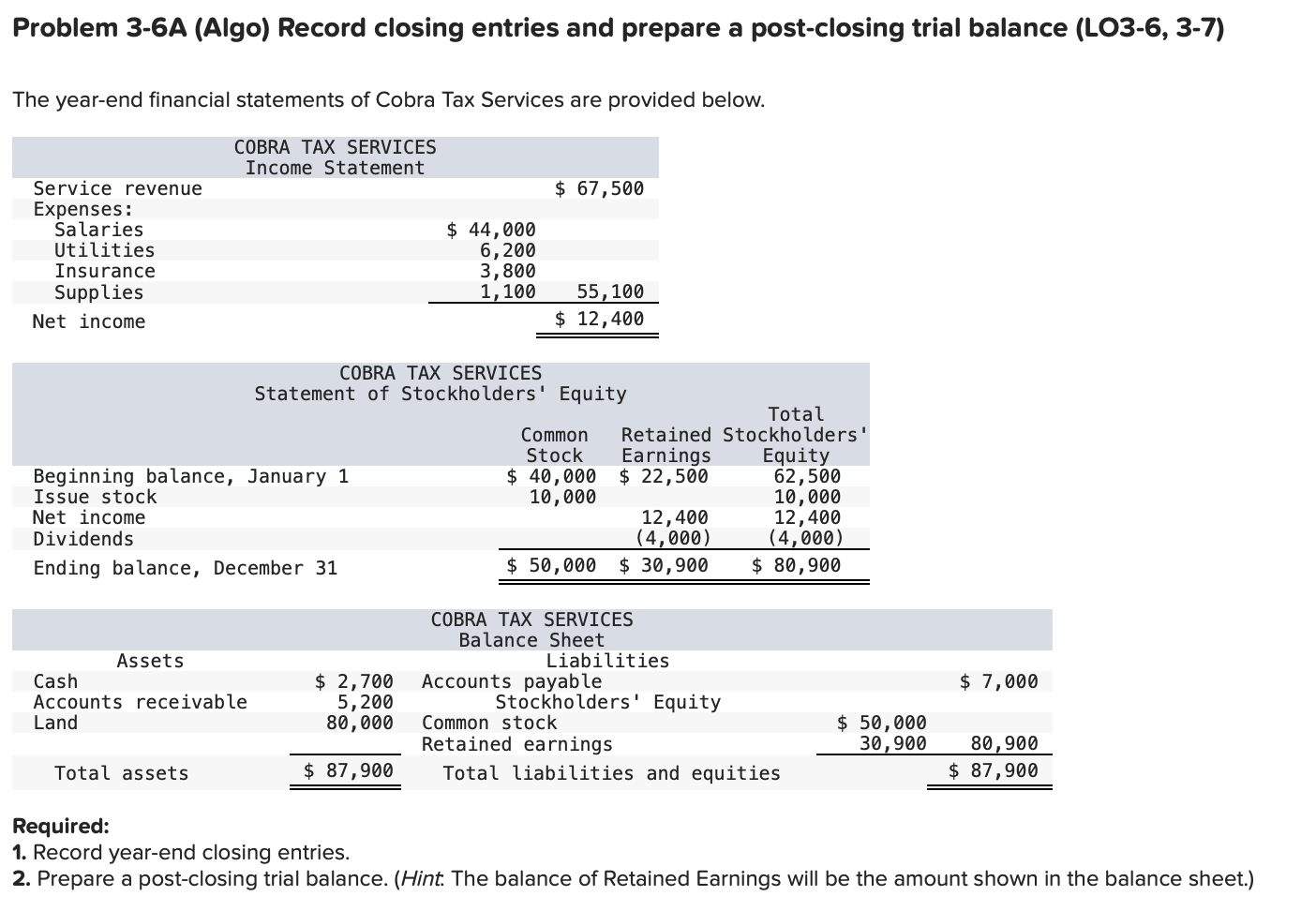

Question: Problem 3-6A (Algo) Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) The year-end financial statements of Cobra Tax Services are provided below.

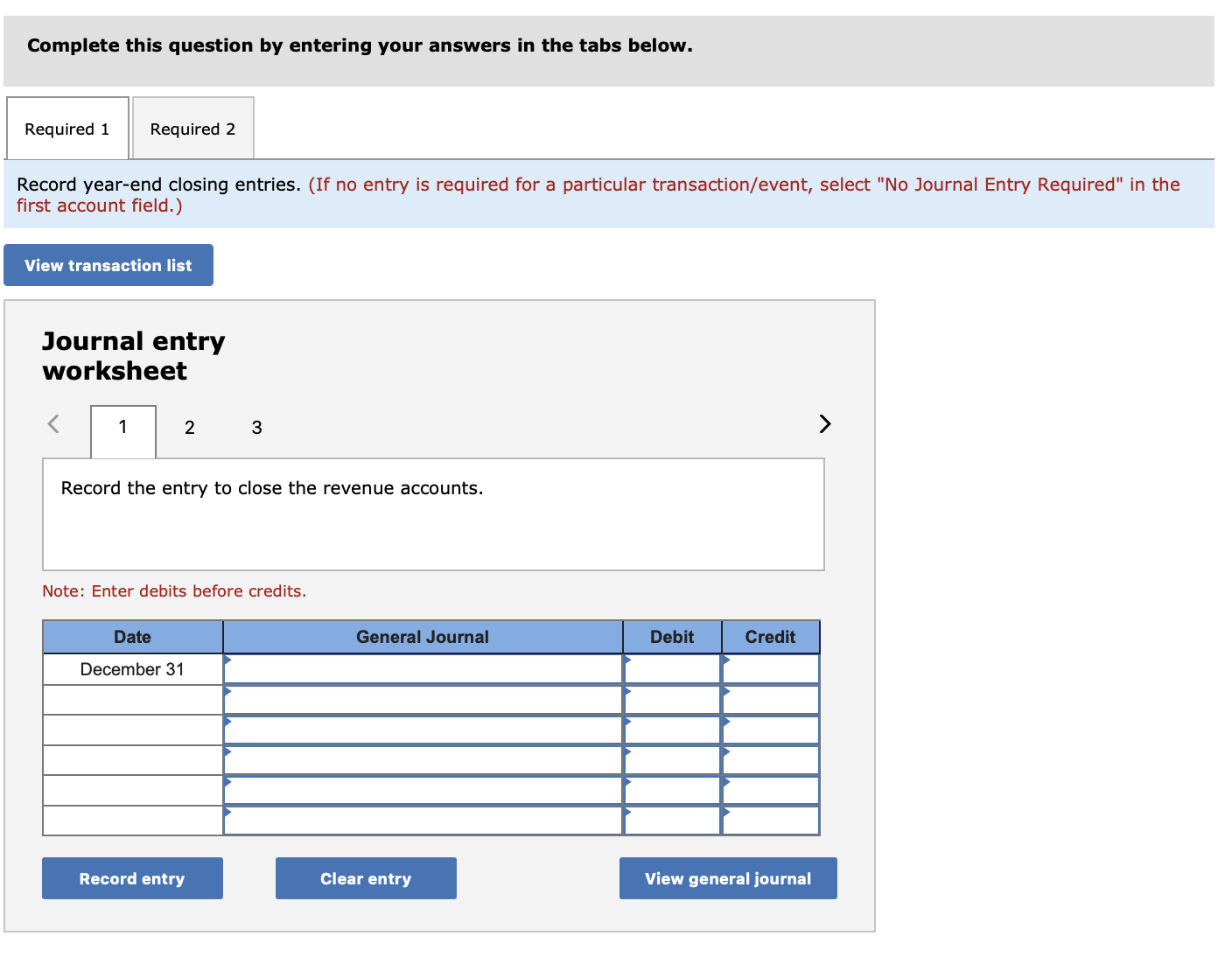

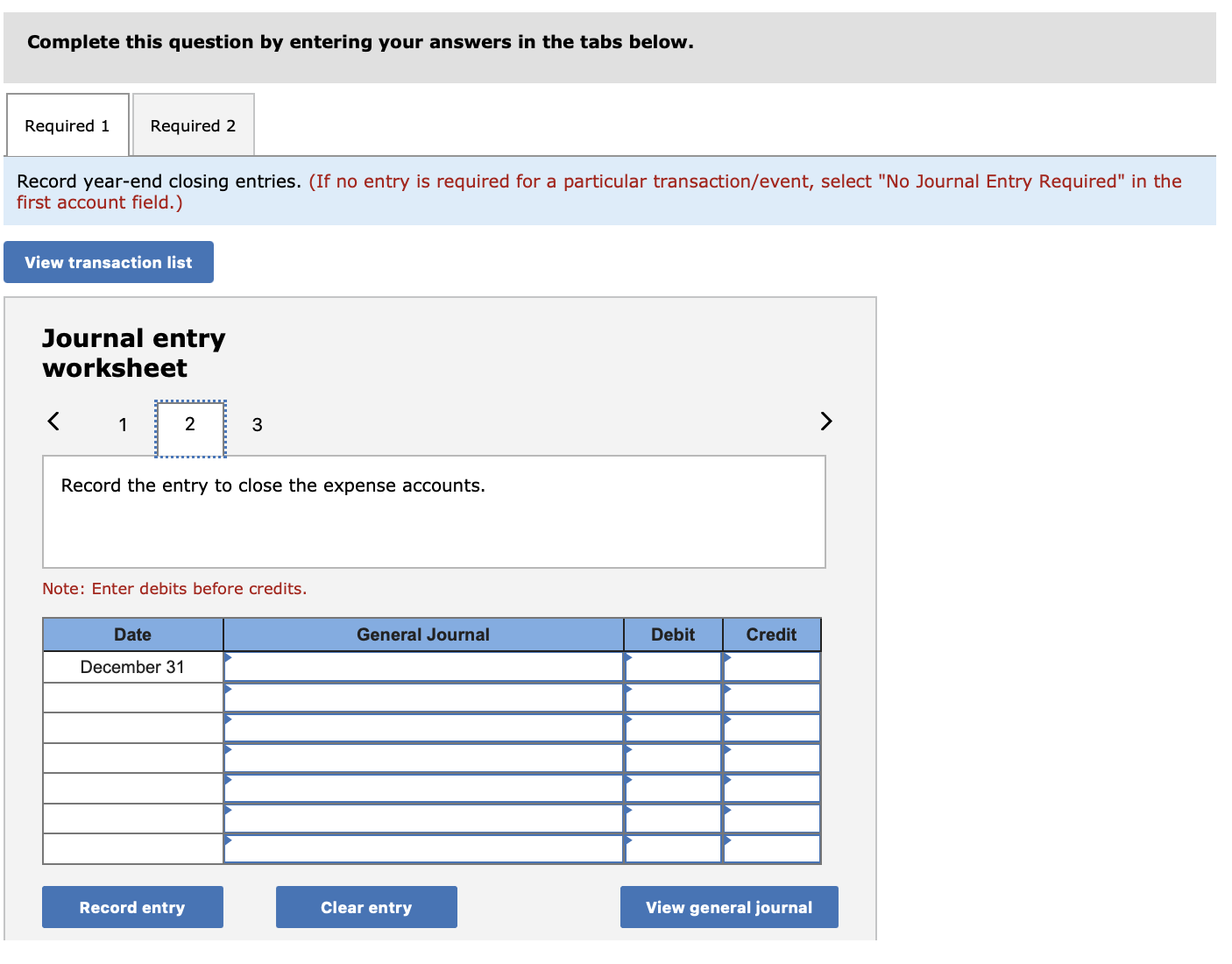

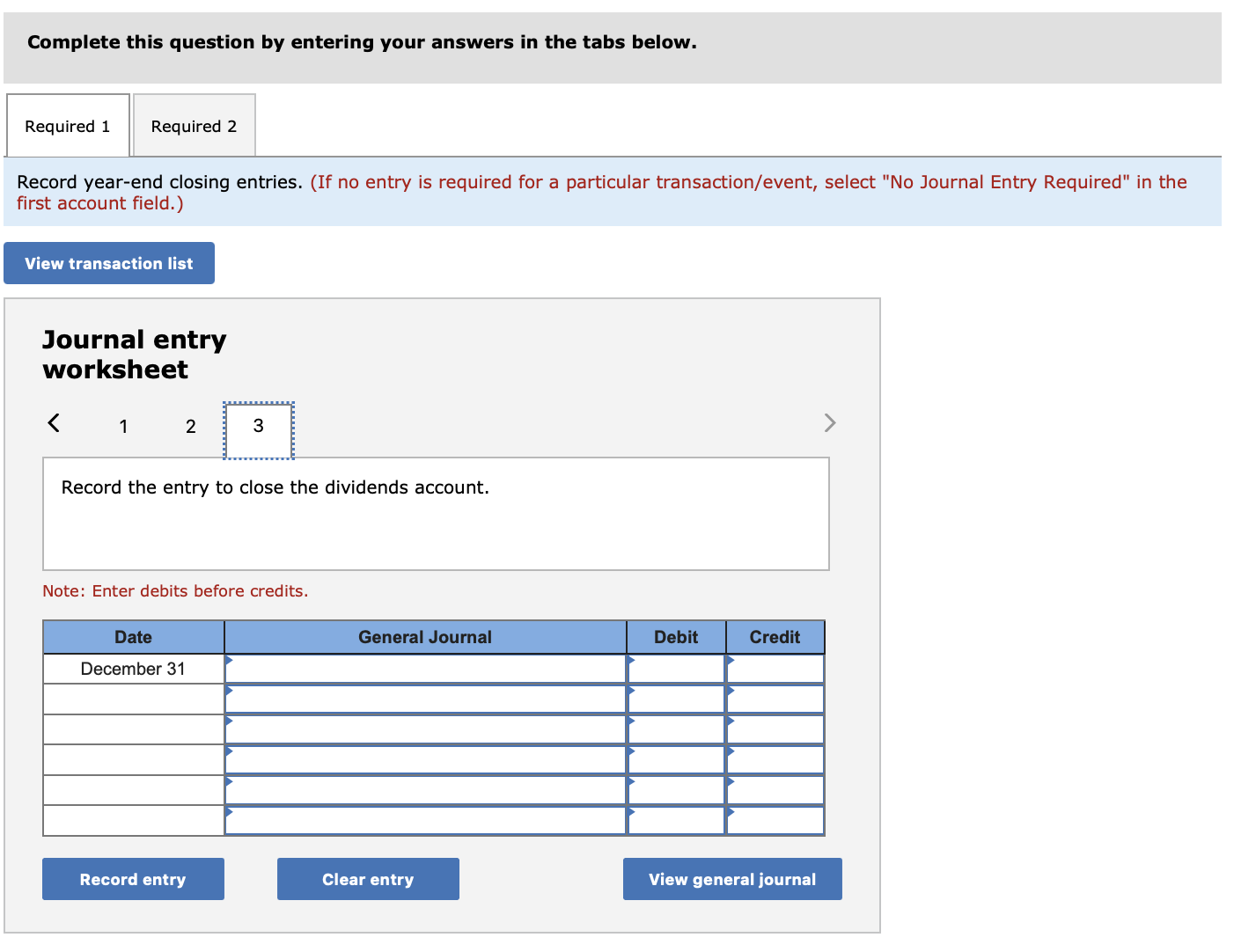

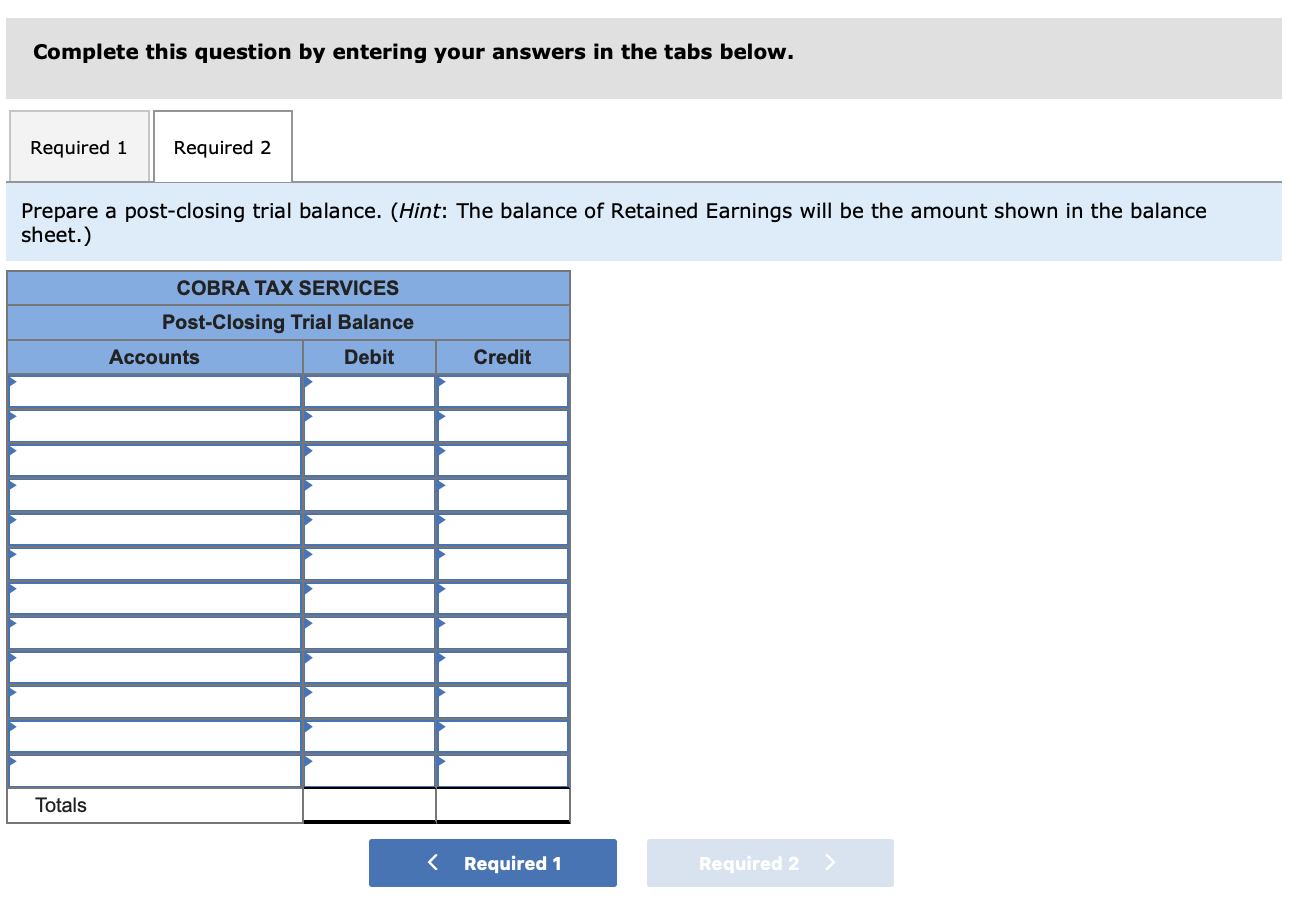

Problem 3-6A (Algo) Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) The year-end financial statements of Cobra Tax Services are provided below. Required: 1. Record year-end closing entries. 2. Prepare a post-closing trial balance. (Hint. The balance of Retained Earnings will be the amount shown in the balance sheet.) Complete this question by entering your answers in the tabs below. Record year-end closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the entry to close the revenue accounts. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Record year-end closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Record year-end closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the entry to close the dividends account. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare a post-closing trial balance. (Hint: The balance of Retained Earnings will be the amount shown in the balance sheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts