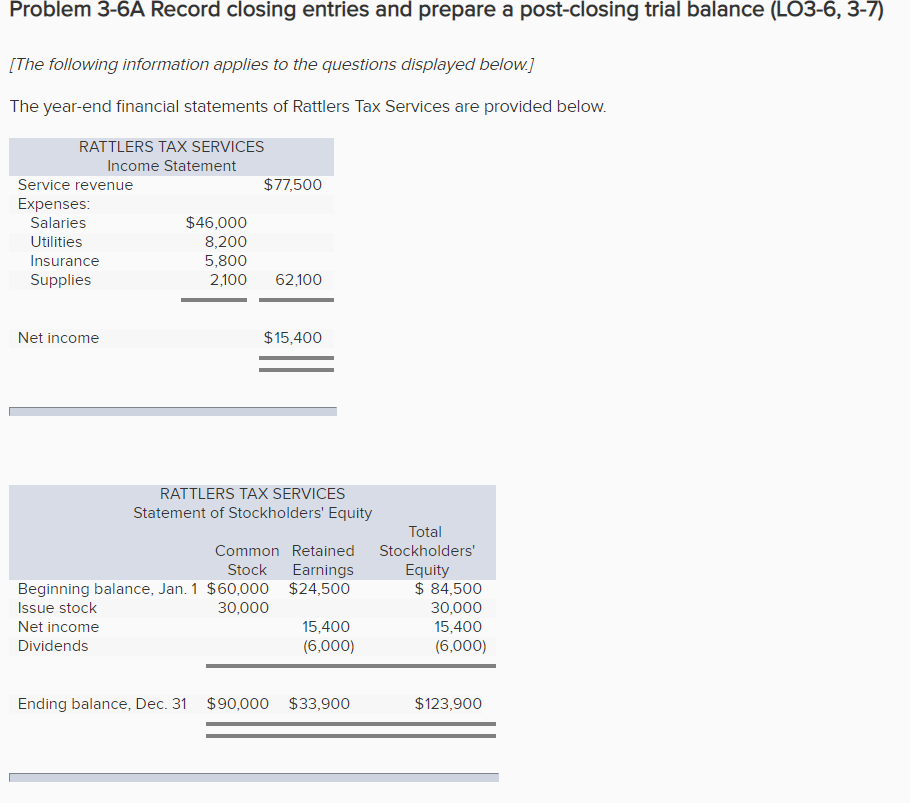

Question: Problem 3-6A Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) [The following information applies to the questions displayed below.] The year-end financial

![(LO3-6, 3-7) [The following information applies to the questions displayed below.] The](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f96108be0f0_33666f961087076d.jpg)

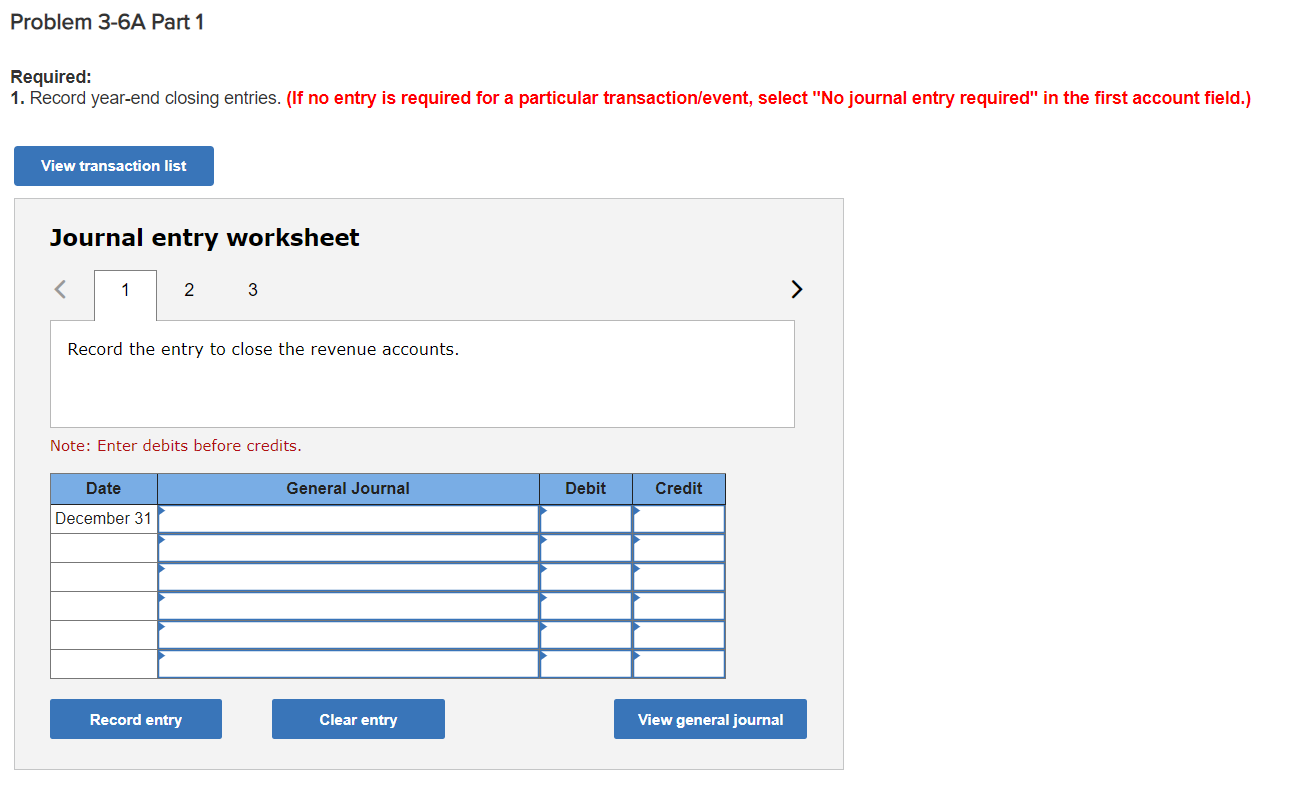

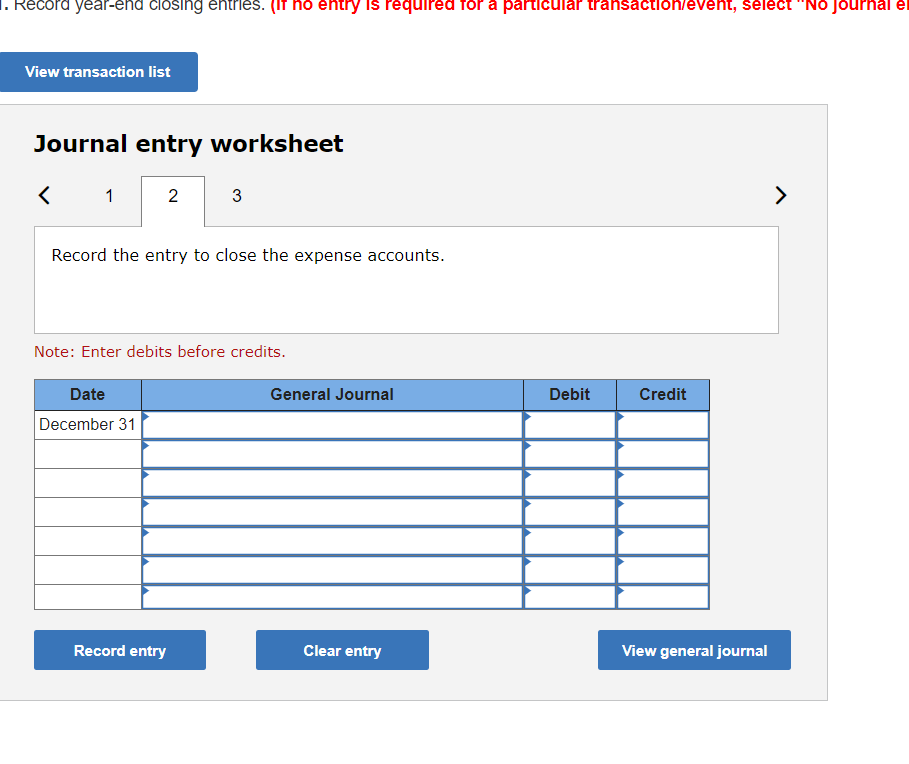

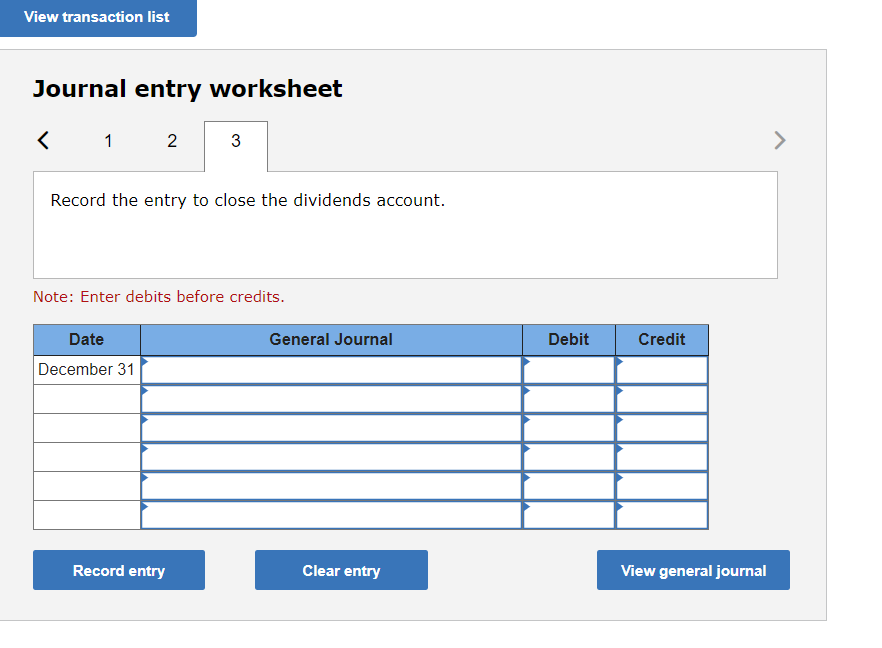

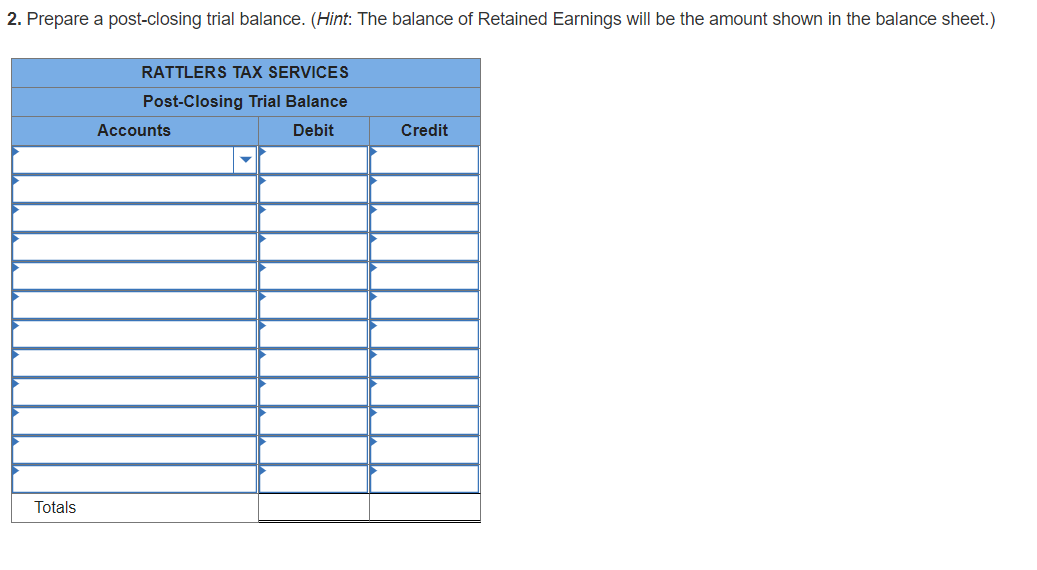

Problem 3-6A Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) [The following information applies to the questions displayed below.] The year-end financial statements of Rattlers Tax Services are provided below. RATTLERS TAX SERVICES Income Statement Service revenue $77,500 Expenses: Salaries $46,000 Utilities 8,200 Insurance 5,800 Supplies 2,100 62,100 Net income $15,400 RATTLERS TAX SERVICES Statement of Stockholders' Equity Total Common Retained Stockholders' Stock Earnings Equity Beginning balance, Jan. 1 $60,000 $24,500 $ 84,500 Issue stock 30,000 30,000 Net income 15,400 15,400 Dividends (6,000) (6,000) Ending balance, Dec. 31 $90,000 $33,900 $123,900 Assets Cash Accounts receivable Land RATTLERS TAX SERVICES Balance Sheet Liabilities $ 4,700 Accounts payable 7,200 Stockholders' Equity: 115,000 Common stock Retained earnings $ 3,000 $90,000 33,900 123,900 Total assets $126,900 Total liabilities and equities $126,900 Problem 3-6A Part 1 Required: 1. Record year-end closing entries. (If no entry is required for a particular transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry to close the revenue accounts. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Record entry Clear entry View general journal 1. Record year-end closing entries. (If no entry is required for a particular transaction/event, select "No journal e View transaction list Journal entry worksheet Record the entry to close the expense accounts. Note: Enter debits before credits. General Journal Debit Credit Date December 31 Record entry Clear entry View general journal View transaction list Journal entry worksheet Record the entry to close the dividends account. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Record entry Clear entry View general journal 2. Prepare a post-closing trial balance. (Hint: The balance of Retained Earnings will be the amount shown in the balance sheet.) RATTLERS TAX SERVICES Post-Closing Trial Balance Accounts Debit Credit Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts