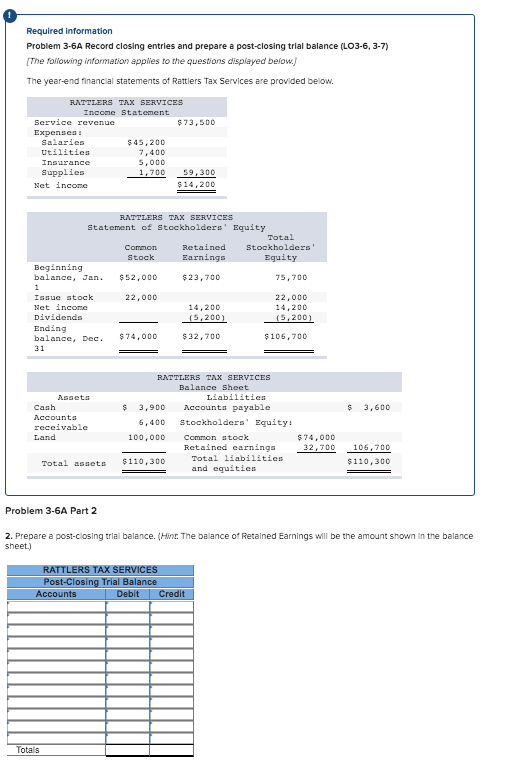

Question: Required information Problem 3-6A Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) The following information applies to the questions displayed below The

Required information Problem 3-6A Record closing entries and prepare a post-closing trial balance (LO3-6, 3-7) The following information applies to the questions displayed below The year-end financial statements of Rattlers Tax Services are provided below. BUTTLERS TAX SERVICES Income Statement Service revenue $ 73,500 Expenses Salaries $ 45,200 Utilities 7.400 Insurance 5,000 Supplies 1,700 59,300 Net Income $14,200 FUTTLERS TAX SERVICES Statement of Stockholders' Equity Total Common Retained Stockholders' Stock Earnings Equity Beginning balance, Jan. $52,000 $23,700 75,700 22,000 Issue stock Net Income Dividends Ending balance, Dee 22.000 14,200 (5,200 14,200 (5,200) $32,700 $ 74,000 $106,700 $ 3,600 Asseta Canh. Accounta receivable Land RATTLERS TAX SERVICES Balance Sheet Liabilities $ 3,900 Accounts payable 6,400 Stockholders' Equity! 100,000 Common stock Retained warnings $110,300 Total Blablitics and equities $74,000 32,700 Total assets $110,300 Problem 3-6A Part 2 2. Prepare a post-closing trial balance. (Hint: The balance of Retained Earnings will be the amount shown in the balance sheet.) RATTLERS TAX SERVICES Post-Closing Trial Balance Accounts Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts