Question: Problem 4 (10 marks) ABC Tasking Ltd is considering a project with an NPV of $0.5 million but it has not yet included in the

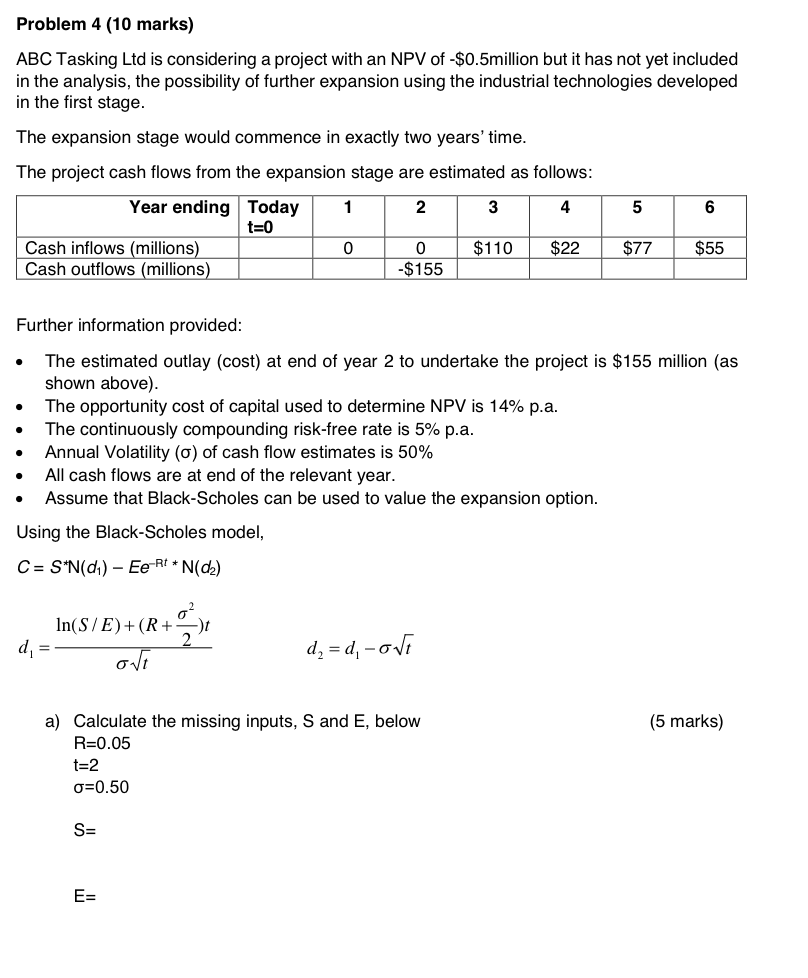

Problem 4 (10 marks) ABC Tasking Ltd is considering a project with an NPV of $0.5 million but it has not yet included in the analysis, the possibility of further expansion using the industrial technologies developed in the first stage. The expansion stage would commence in exactly two years' time. The project cash flows from the expansion stage are estimated as follows: Further information provided: - The estimated outlay (cost) at end of year 2 to undertake the project is $155 million (as shown above). - The opportunity cost of capital used to determine NPV is 14% p.a. - The continuously compounding risk-free rate is 5% p.a. - Annual Volatility () of cash flow estimates is 50% - All cash flows are at end of the relevant year. - Assume that Black-Scholes can be used to value the expansion option. Using the Black-Scholes model, C=SN(d1)EeRtN(d2) d1=tln(S/E)+(R+22)td2=d1t a) Calculate the missing inputs, S and E, below (5 marks) R=0.05t=2=0.50 Problem 4 (10 marks) ABC Tasking Ltd is considering a project with an NPV of $0.5 million but it has not yet included in the analysis, the possibility of further expansion using the industrial technologies developed in the first stage. The expansion stage would commence in exactly two years' time. The project cash flows from the expansion stage are estimated as follows: Further information provided: - The estimated outlay (cost) at end of year 2 to undertake the project is $155 million (as shown above). - The opportunity cost of capital used to determine NPV is 14% p.a. - The continuously compounding risk-free rate is 5% p.a. - Annual Volatility () of cash flow estimates is 50% - All cash flows are at end of the relevant year. - Assume that Black-Scholes can be used to value the expansion option. Using the Black-Scholes model, C=SN(d1)EeRtN(d2) d1=tln(S/E)+(R+22)td2=d1t a) Calculate the missing inputs, S and E, below (5 marks) R=0.05t=2=0.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts