Question: Problem 4 - 10 points HiDiv Corp. has just paid a dividend of $3.00. An analyst forecasts annual dividend growth of 11% for the next

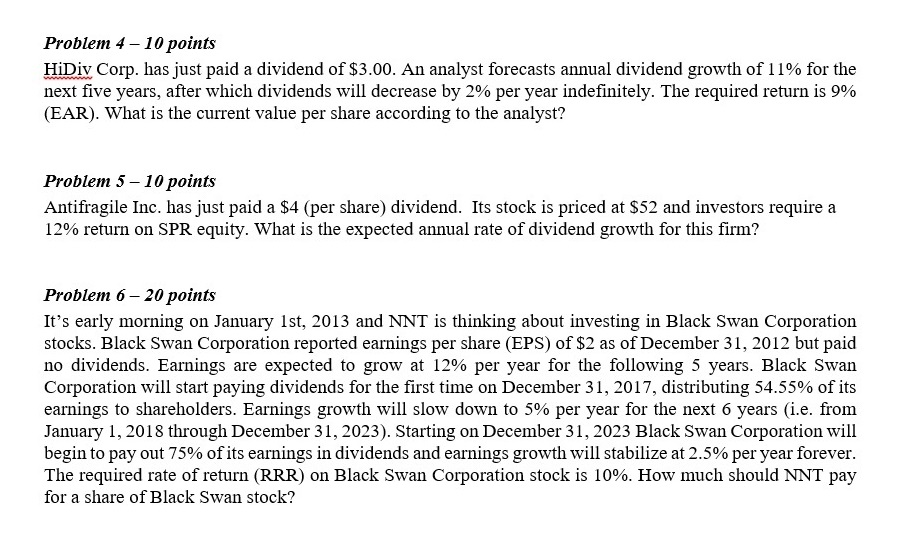

Problem 4 - 10 points HiDiv Corp. has just paid a dividend of $3.00. An analyst forecasts annual dividend growth of 11% for the next five years, after which dividends will decrease by 2% per year indefinitely. The required return is 9% (EAR). What is the current value per share according to the analyst? Problem 5 10 points Antifragile Inc. has just paid a $4 (per share) dividend. Its stock is priced at $52 and investors require a 12% return on SPR equity. What is the expected annual rate of dividend growth for this firm? Problem 6 - 20 points It's early morning on January 1st, 2013 and NNT is thinking about investing in Black Swan Corporation stocks. Black Swan Corporation reported earnings per share (EPS) of $2 as of December 31, 2012 but paid no dividends. Earnings are expected to grow at 12% per year for the following 5 years. Black Swan Corporation will start paying dividends for the first time on December 31, 2017, distributing 54.55% of its earnings to shareholders. Earnings growth will slow down to 5% per year for the next 6 years (i.e. from January 1, 2018 through December 31, 2023). Starting on December 31, 2023 Black Swan Corporation will begin to pay out 75% of its earnings in dividends and earnings growth will stabilize at 2.5% per year forever. The required rate of return (RRR) on Black Swan Corporation stock is 10%. How much should NNT pay for a share of Black Swan stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts