Question: Problem 4 (10 points) Suppose that stock A is currently selling at $105. A call option on stock A expiring after 3 years is selling

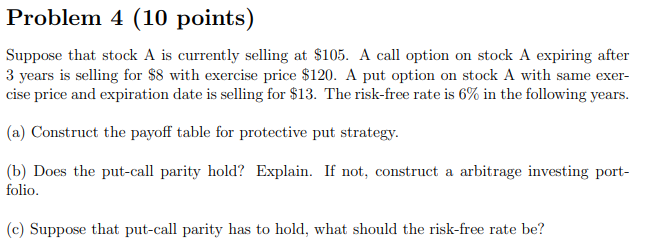

Problem 4 (10 points) Suppose that stock A is currently selling at $105. A call option on stock A expiring after 3 years is selling for $8 with exercise price $120. A put option on stock A with same exer- cise price and expiration date is selling for $13. The risk-free rate is 6% in the following years. (a) Construct the payoff table for protective put strategy. (b) Does the put-call parity hold? Explain. If not, construct a arbitrage investing port- folio. (C) Suppose that put-call parity has to hold, what should the risk-free rate be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts