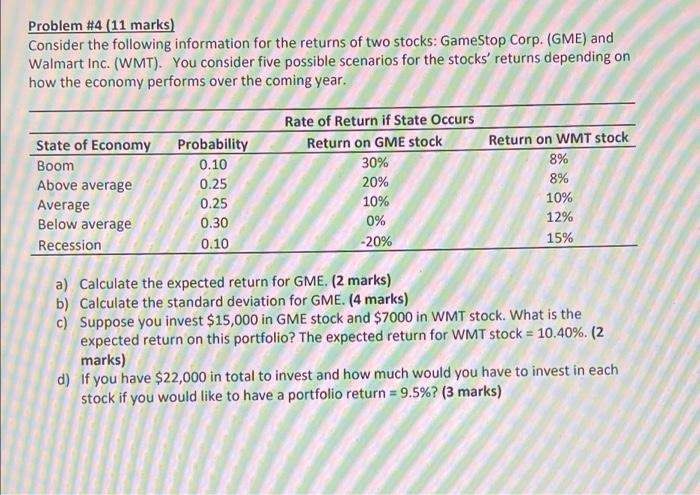

Question: Problem #4 (11 marks) Consider the following information for the returns of two stocks: GameStop Corp. (GME) and Walmart Inc. (WMT). You consider five possible

Problem #4 (11 marks) Consider the following information for the returns of two stocks: GameStop Corp. (GME) and Walmart Inc. (WMT). You consider five possible scenarios for the stocks' returns depending on how the economy performs over the coming year. State of Economy Boom Above average Average Below average Recession Probability 0.10 0.25 0.25 0.30 0.10 Rate of Return if State Occurs Return on GME stock 30% 20% 10% 0% -20% Return on WMT stock 8% 8% 10% 12% 15% a) Calculate the expected return for GME. (2 marks) b) Calculate the standard deviation for GME. (4 marks) c) Suppose you invest $15,000 in GME stock and $7000 in WMT stock. What is the expected return on this portfolio? The expected return for WMT stock = 10.40%. (2 marks) d) If you have $22,000 in total to invest and how much would you have to invest in each stock if you would like to have a portfolio return = 9.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts