Question: Problem 4 ( 2 0 points ) Your company is considering leasing or purchasing an asset that costs $ 1 , 0 0 0 ,

Problem points

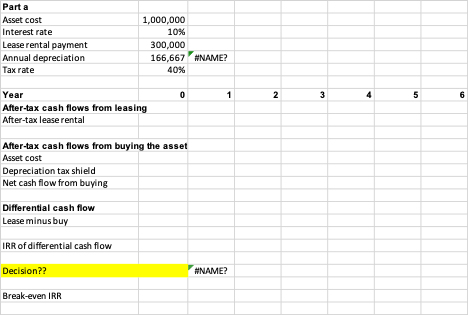

Your company is considering leasing or purchasing an asset that costs $ The asset, if purchased, will be depreciated on a straightline basis over years to a zero residual value. A leasing company is willing to lease the asset for # per year; the first payment on the lease is due at the time the lease is undertaken ie year and the remaining payments are due the beginning of years Your company has a tax rate Tc and can borrow at from the bank.

a Should your company lease or purchase the asset output template provided

b What is the maximum lease payment it will agree to pay?

Please workout in excel and show formula's and excel functions

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock