Question: Problem 4 (24 points) Use the following data for answering all problem sub-parts: A put option will mature in 6 months. The standard deviation of

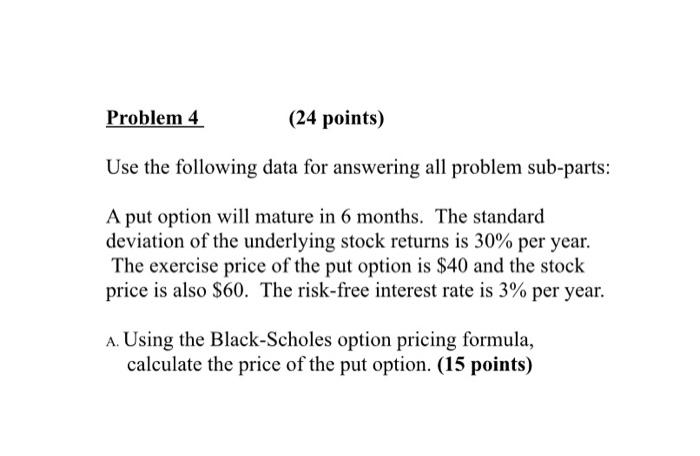

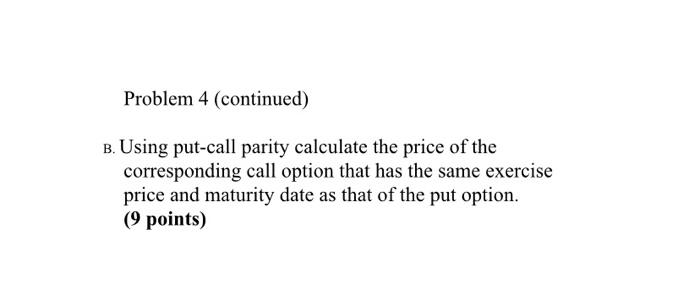

Problem 4 (24 points) Use the following data for answering all problem sub-parts: A put option will mature in 6 months. The standard deviation of the underlying stock returns is 30% per year. The exercise price of the put option is $40 and the stock price is also $60. The risk-free interest rate is 3% per year. A. Using the Black-Scholes option pricing formula, calculate the price of the put option. (15 points) Problem 4 (continued) B. Using put-call parity calculate the price of the corresponding call option that has the same exercise price and maturity date as that of the put option. (9 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts