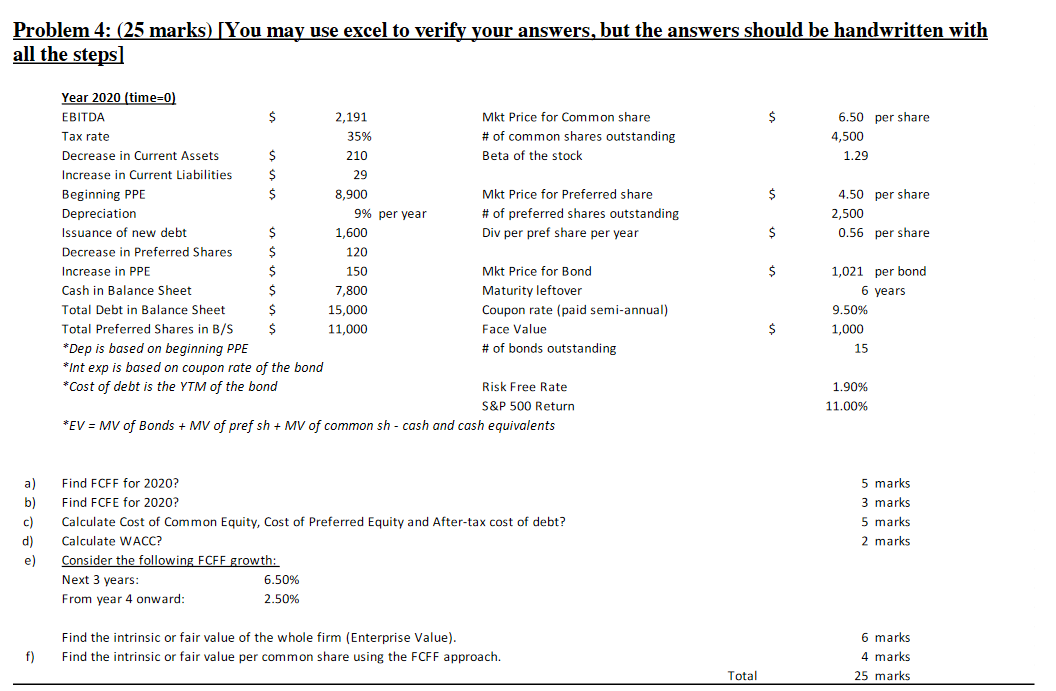

Question: Problem 4: (25 marks) [You may use excel to verify your answers, but the answers should be handwritten with all the steps $ 6.50 per

Problem 4: (25 marks) [You may use excel to verify your answers, but the answers should be handwritten with all the steps $ 6.50 per share 4,500 1.29 $ 4.50 per share 2,500 0.56 per share $ Year 2020 (time=0) EBITDA $ 2,191 Mkt Price for Common share Tax rate 35% # of common shares outstanding Decrease in Current Assets $ 210 Beta of the stock Increase in Current Liabilities $ 29 Beginning PPE $ 8,900 Mkt Price for Preferred share Depreciation 9% per year # of preferred shares outstanding Issuance of new debt $ 1,600 Div per pref share per year Decrease in Preferred Shares $ 120 Increase in PPE $ 150 Mkt Price for Bond Cash in Balance Sheet $ 7,800 Maturity leftover Total Debt in Balance Sheet $ 15,000 Coupon rate (paid semi-annual) Total Preferred Shares in B/S $ 11,000 Face Value *Dep is based on beginning PPE # of bonds outstanding *Int exp is based on coupon rate of the bond *Cost of debt is the YTM of the bond Risk Free Rate S&P 500 Return *EV = MV of Bonds + MV of pref sh + MV of common sh - cash and cash equivalents $ 1,021 per bond 6 years 9.50% 1,000 15 $ 1.90% 11.00% a) b) Find FCFF for 2020? Find FCFE for 2020? Calculate Cost of Common Equity, Cost of Preferred Equity and After-tax cost of debt? Calculate WACC? Consider the following FCFF growth: Next 3 years: 6.50% From year 4 onward: 2.50% 5 marks 3 marks 5 marks 2 marks c) d) e) Find the intrinsic or fair value of the whole firm (Enterprise Value). Find the intrinsic or fair value per common share using the FCFF approach. f) 6 marks 4 marks 25 marks Total Problem 4: (25 marks) [You may use excel to verify your answers, but the answers should be handwritten with all the steps $ 6.50 per share 4,500 1.29 $ 4.50 per share 2,500 0.56 per share $ Year 2020 (time=0) EBITDA $ 2,191 Mkt Price for Common share Tax rate 35% # of common shares outstanding Decrease in Current Assets $ 210 Beta of the stock Increase in Current Liabilities $ 29 Beginning PPE $ 8,900 Mkt Price for Preferred share Depreciation 9% per year # of preferred shares outstanding Issuance of new debt $ 1,600 Div per pref share per year Decrease in Preferred Shares $ 120 Increase in PPE $ 150 Mkt Price for Bond Cash in Balance Sheet $ 7,800 Maturity leftover Total Debt in Balance Sheet $ 15,000 Coupon rate (paid semi-annual) Total Preferred Shares in B/S $ 11,000 Face Value *Dep is based on beginning PPE # of bonds outstanding *Int exp is based on coupon rate of the bond *Cost of debt is the YTM of the bond Risk Free Rate S&P 500 Return *EV = MV of Bonds + MV of pref sh + MV of common sh - cash and cash equivalents $ 1,021 per bond 6 years 9.50% 1,000 15 $ 1.90% 11.00% a) b) Find FCFF for 2020? Find FCFE for 2020? Calculate Cost of Common Equity, Cost of Preferred Equity and After-tax cost of debt? Calculate WACC? Consider the following FCFF growth: Next 3 years: 6.50% From year 4 onward: 2.50% 5 marks 3 marks 5 marks 2 marks c) d) e) Find the intrinsic or fair value of the whole firm (Enterprise Value). Find the intrinsic or fair value per common share using the FCFF approach. f) 6 marks 4 marks 25 marks Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts