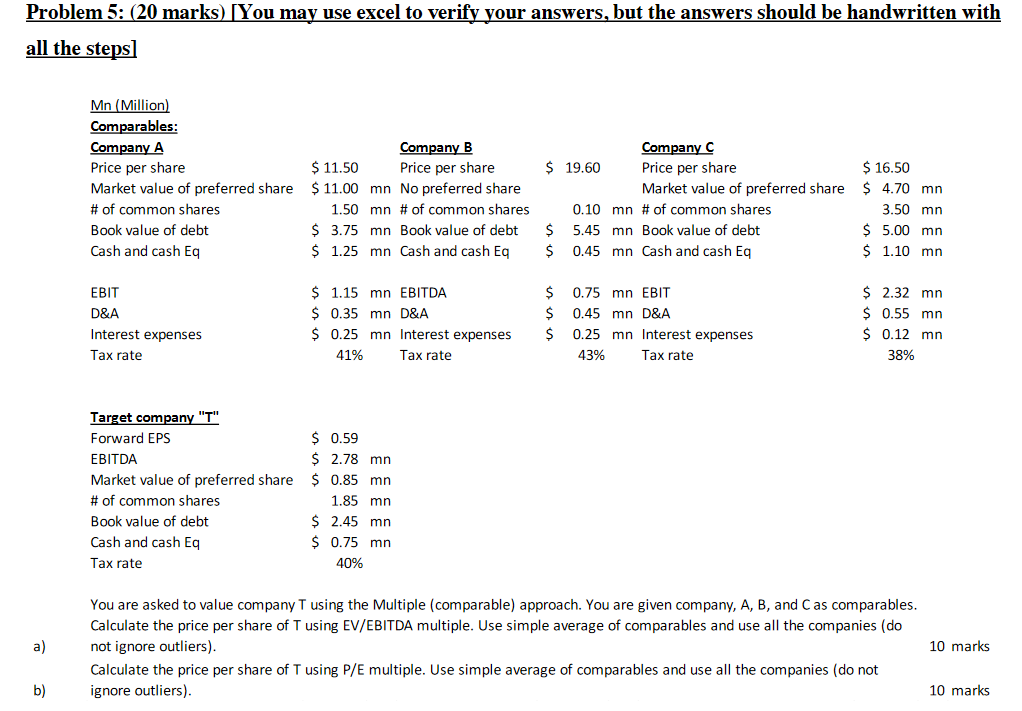

Question: Problem 5: (20 marks) [You may use excel to verify your answers, but the answers should be handwritten with all the steps) Mn (Million) Comparables:

Problem 5: (20 marks) [You may use excel to verify your answers, but the answers should be handwritten with all the steps) Mn (Million) Comparables: Company A Price per share Market value of preferred share # of common shares Book value of debt Cash and cash Eq Company B $ 11.50 Price per share $ 11.00 mn No preferred share 1.50 mn # of common shares $ 3.75 mn Book value of debt $ 1.25 mn Cash and cash Eq Company C $ 19.60 Price per share $ 16.50 Market value of preferred share $ 4.70 mn 0.10 mn # of common shares 3.50 mn $ 5.45 mn Book value of debt $ 5.00 mn $ 0.45 mn Cash and cash Eq $ 1.10 mn EBIT D&A Interest expenses Tax rate $ 1.15 mn EBITDA $ 0.35 mn D&A $ 0.25 mn Interest expenses 41% Tax rate $ $ S 0.75 mn EBIT 0.45 mn D&A 0.25 mn Interest expenses 43% Tax rate $ 2.32 mn $ 0.55 mn $ 0.12 mn 38% Target company "T" Forward EPS EBITDA Market value of preferred share # of common shares Book value of debt Cash and cash Eq $ 0.59 $ 2.78 mn $ 0.85 mn 1.85 mn $ 2.45 mn $ 0.75 mn 40% Tax rate You are asked to value company T using the Multiple comparable) approach. You are given company, A, B, and Cas comparables. Calculate the price per share of T using EV/EBITDA multiple. Use simple average of comparables and use all the companies (do not ignore outliers). Calculate the price per share of T using P/E multiple. Use simple average of comparables and use all the companies (do not ignore outliers). 10 marks b) 10 marks Problem 5: (20 marks) [You may use excel to verify your answers, but the answers should be handwritten with all the steps) Mn (Million) Comparables: Company A Price per share Market value of preferred share # of common shares Book value of debt Cash and cash Eq Company B $ 11.50 Price per share $ 11.00 mn No preferred share 1.50 mn # of common shares $ 3.75 mn Book value of debt $ 1.25 mn Cash and cash Eq Company C $ 19.60 Price per share $ 16.50 Market value of preferred share $ 4.70 mn 0.10 mn # of common shares 3.50 mn $ 5.45 mn Book value of debt $ 5.00 mn $ 0.45 mn Cash and cash Eq $ 1.10 mn EBIT D&A Interest expenses Tax rate $ 1.15 mn EBITDA $ 0.35 mn D&A $ 0.25 mn Interest expenses 41% Tax rate $ $ S 0.75 mn EBIT 0.45 mn D&A 0.25 mn Interest expenses 43% Tax rate $ 2.32 mn $ 0.55 mn $ 0.12 mn 38% Target company "T" Forward EPS EBITDA Market value of preferred share # of common shares Book value of debt Cash and cash Eq $ 0.59 $ 2.78 mn $ 0.85 mn 1.85 mn $ 2.45 mn $ 0.75 mn 40% Tax rate You are asked to value company T using the Multiple comparable) approach. You are given company, A, B, and Cas comparables. Calculate the price per share of T using EV/EBITDA multiple. Use simple average of comparables and use all the companies (do not ignore outliers). Calculate the price per share of T using P/E multiple. Use simple average of comparables and use all the companies (do not ignore outliers). 10 marks b) 10 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts