Question: Problem 4 (2ps): You have been hired as a management consultant by AD Corporation to evaluate whether it has an appropriate amount of debt (the

Problem 4 (2ps):

You have been hired as a management consultant by AD Corporation to evaluate whether it has an appropriate amount of debt (the company is worried about a leveraged buyout). You have collected the following information on ADs current position:

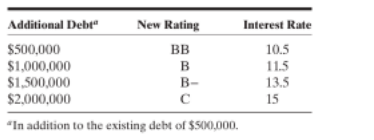

There are 90,000 shares outstanding at $25 per share. The stock has a beta of 1.25. The company has $500,000 in long-term debt outstanding and is currently rated BBB. The current market interest rate is 10% on BBB bonds and 5% on Treasury bonds. The companys marginal tax rate is 40%. You proceed to collect the data on what increasing debt will do to the companys ratings:

How much additional debt should the company take on? (hint: think about the optimal capital structure).

Additional Debt New Rating Interest Rate $500,000 BB 10.5 $1,000,000 B 11.5 $1,500,000 B- 13.5 $2,000,000 15 "In addition to the existing debt of $500,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts