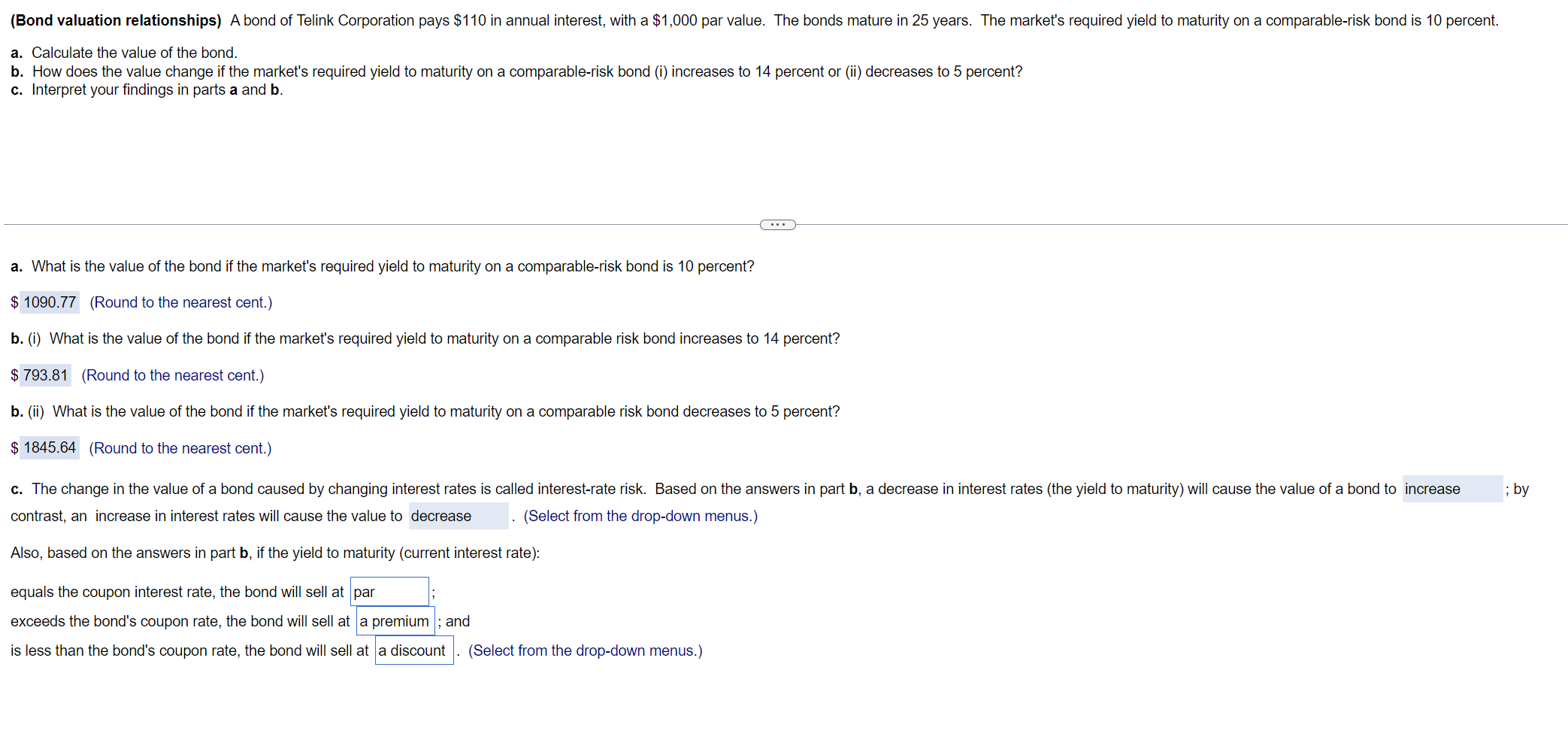

Question: Please help with last part Also, based on the answers in part b, if the yield to maturity (current interest rate): equals the coupon interest

Please help with last part

Also, based on the answers in part

b,

if the yield to maturity (current interest rate):

equals the coupon interest rate, the bond will sell at

par

;

exceeds the bond's coupon rate, the bond will sell at

a premium

; and

is less than the bond's coupon rate, the bond will sell at

a discount

. (

a. Calculate the value of the bond. b. How does the value change if the market's required yield to maturity on a comparable-risk bond (i) increases to 14 percent or (ii) decreases to 5 percent? c. Interpret your findings in parts a and b. a. What is the value of the bond if the market's required yield to maturity on a comparable-risk bond is 10 percent? $1090.77 (Round to the nearest cent.) b. (i) What is the value of the bond if the market's required yield to maturity on a comparable risk bond increases to 14 percent? $793.81 (Round to the nearest cent.) b. (ii) What is the value of the bond if the market's required yield to maturity on a comparable risk bond decreases to 5 percent? (Round to the nearest cent.) contrast, an increase in interest rates will cause the value to (Select from the drop-down menus.) Also, based on the answers in part b, if the yield to maturity (current interest rate): equals the coupon interest rate, the bond will sell at exceeds the bond's coupon rate, the bond will sell at ; and is less than the bond's coupon rate, the bond will sell at (Select from the drop-down menus.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts