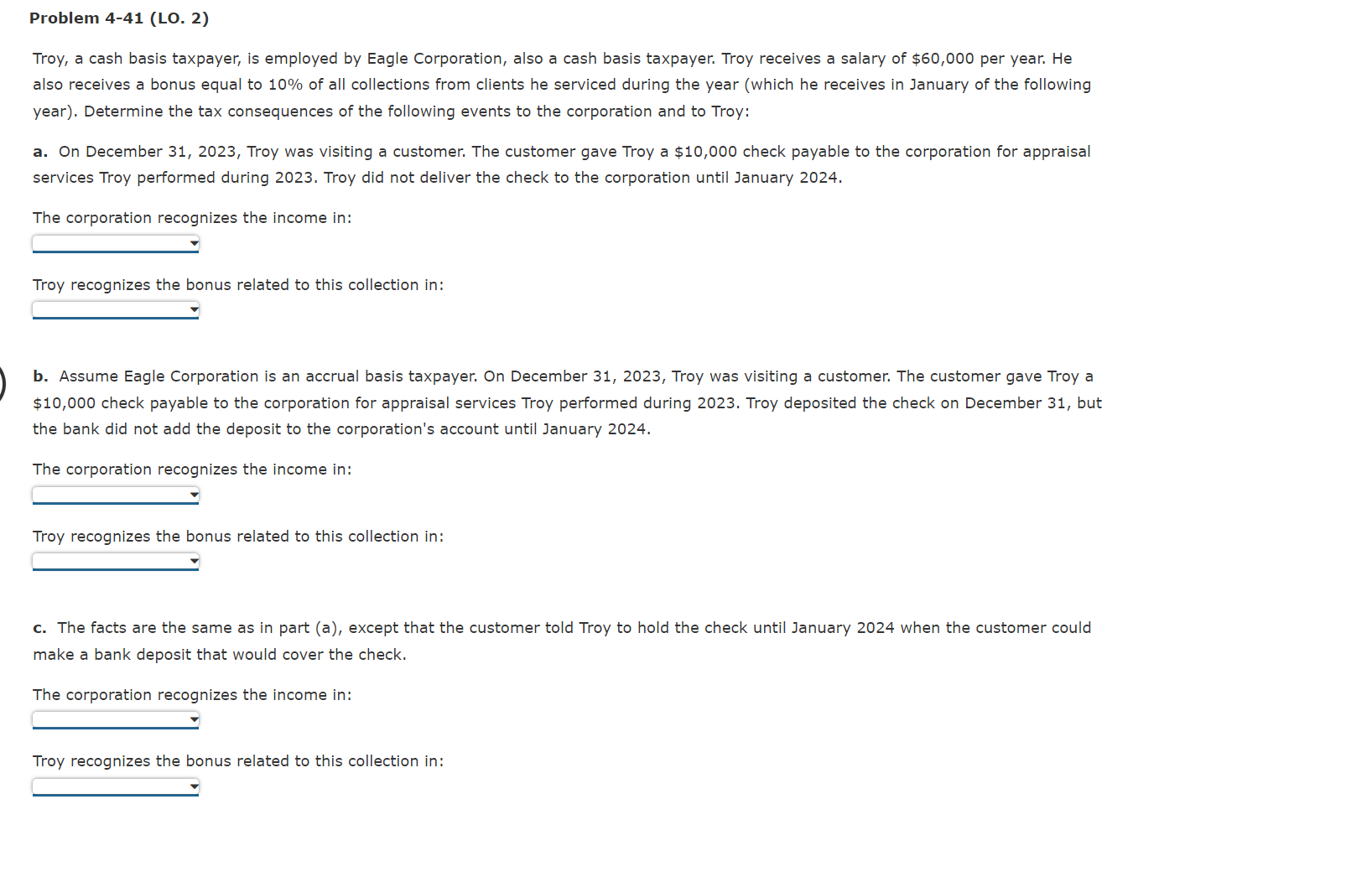

Question: Problem 4 - 4 1 ( LO . 2 ) Troy, a cash basis taxpayer, is employed by Eagle Corporation, also a cash basis taxpayer.

Problem LO

Troy, a cash basis taxpayer, is employed by Eagle Corporation, also a cash basis taxpayer. Troy receives a salary of $ per year. He

also receives a bonus equal to of all collections from clients he serviced during the year which he receives in January of the following

year Determine the tax consequences of the following events to the corporation and to Troy:

a On December Troy was visiting a customer. The customer gave Troy a $ check payable to the corporation for appraisal

services Troy performed during Troy did not deliver the check to the corporation until January

The corporation recognizes the income in:

Troy recognizes the bonus related to this collection in:

b Assume Eagle Corporation is an accrual basis taxpayer. On December Troy was visiting a customer. The customer gave Troy a

$ check payable to the corporation for appraisal services Troy performed during Troy deposited the check on December but

the bank did not add the deposit to the corporation's account until January

The corporation recognizes the income in:

Troy recognizes the bonus related to this collection in:

c The facts are the same as in part a except that the customer told Troy to hold the check until January when the customer could

make a bank deposit that would cover the check.

The corporation recognizes the income in:

Troy recognizes the bonus related to this collection in:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock