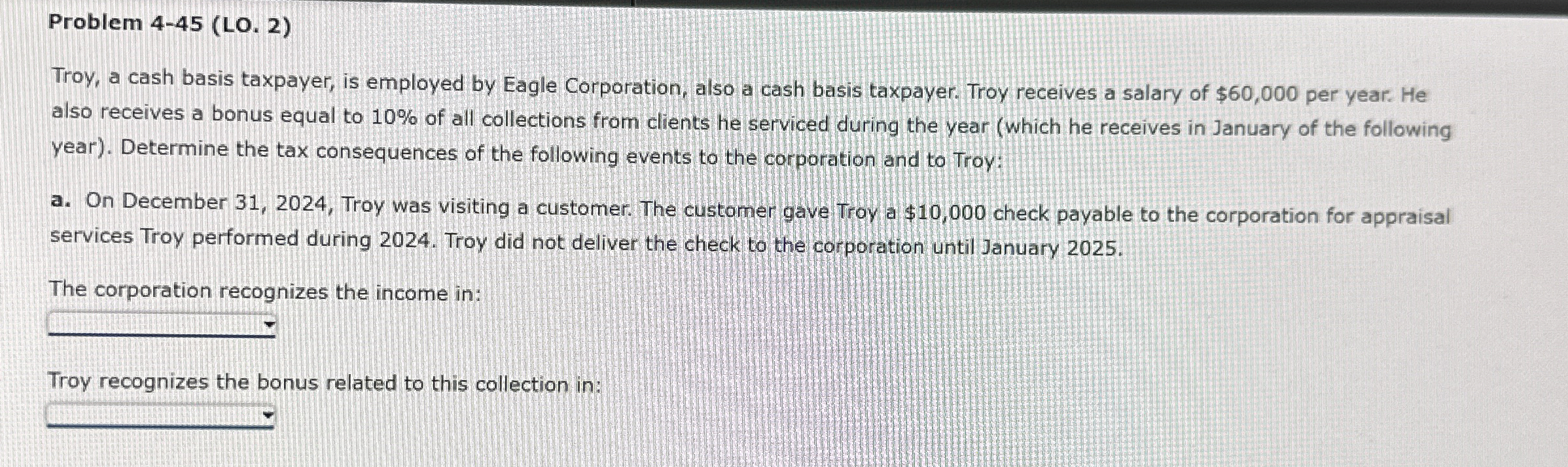

Question: Problem 4 - 4 5 ( LO . 2 ) Troy, a cash basis taxpayer, is employed by Eagle Corporation, also a cash basis taxpayer.

Problem LO

Troy, a cash basis taxpayer, is employed by Eagle Corporation, also a cash basis taxpayer. Troy receives a salary of $ per year. He

also receives a bonus equal to of all collections from clients he serviced during the year which he receives in January of the following

year Determine the tax consequences of the following events to the corporation and to Troy:

a On December Troy was visiting a customer. The customer gave Troy a $ check payable to the corporation for appraisal

services Troy performed during Troy did not deliver the check to the corporation until January

The corporation recognizes the income in:

Troy reoognizes the bonus related to this collection in:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock