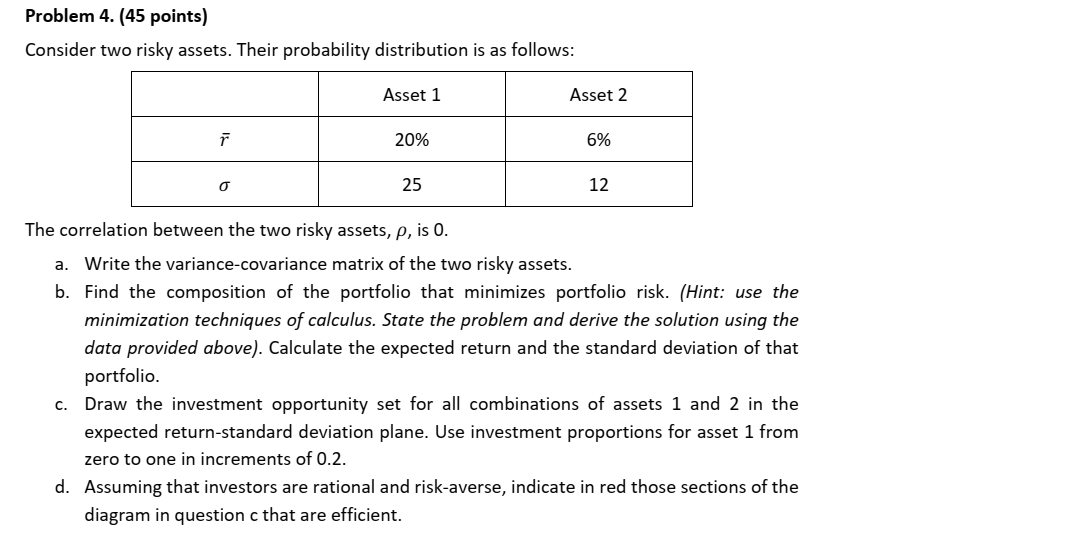

Question: Problem 4. (45 points) Consider two risky assets. Their probability distribution is as follows: Asset 1 Asset 2 20% 6% 25 12 The correlation between

Problem 4. (45 points) Consider two risky assets. Their probability distribution is as follows: Asset 1 Asset 2 20% 6% 25 12 The correlation between the two risky assets, p, is 0. a. Write the variance-covariance matrix of the two risky assets. b. Find the composition of the portfolio that minimizes portfolio risk. (Hint: use the minimization techniques of calculus. State the problem and derive the solution using the data provided above). Calculate the expected return and the standard deviation of that portfolio. c. Draw the investment opportunity set for all combinations of assets 1 and 2 in the expected return-standard deviation plane. Use investment proportions for asset 1 from zero to one in increments of 0.2. d. Assuming that investors are rational and risk-averse, indicate in red those sections of the diagram in question c that are efficient. Problem 4. (45 points) Consider two risky assets. Their probability distribution is as follows: Asset 1 Asset 2 20% 6% 25 12 The correlation between the two risky assets, p, is 0. a. Write the variance-covariance matrix of the two risky assets. b. Find the composition of the portfolio that minimizes portfolio risk. (Hint: use the minimization techniques of calculus. State the problem and derive the solution using the data provided above). Calculate the expected return and the standard deviation of that portfolio. c. Draw the investment opportunity set for all combinations of assets 1 and 2 in the expected return-standard deviation plane. Use investment proportions for asset 1 from zero to one in increments of 0.2. d. Assuming that investors are rational and risk-averse, indicate in red those sections of the diagram in question c that are efficient

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts