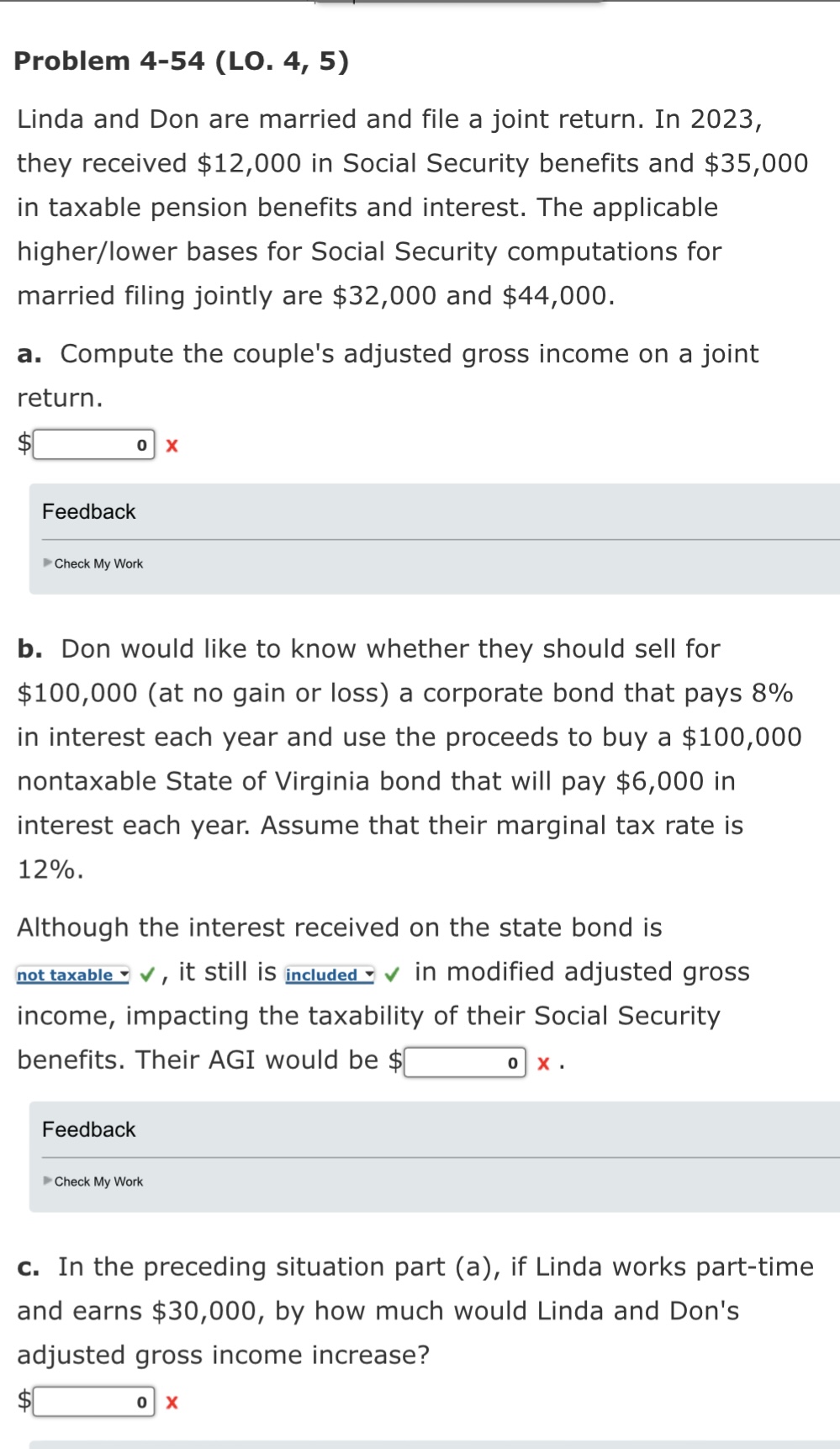

Question: Problem 4 - 5 4 ( LO . 4 , 5 ) Linda and Don are married and file a joint return. In 2 0

Problem LO

Linda and Don are married and file a joint return. In

they received $ in Social Security benefits and $

in taxable pension benefits and interest. The applicable

higherlower bases for Social Security computations for

married filing jointly are $ and $

a Compute the couple's adjusted gross income on a joint

return.

$

Feedbackb. Don would like to know whether they should sell for

$at no gain or loss a corporate bond that pays

in interest each year and use the proceeds to buy a $

nontaxable State of Virginia bond that will pay $ in

interest each year. Assume that their marginal tax rate is

Although the interest received on the state bond is

it still is included in modified adjusted gross

income, impacting the taxability of their Social Security

benefits. Their AGI would be $

Feedback

rCheck My Work

c In the preceding situation part a if Linda works parttime

and earns $ by how much would Linda and Don's

adjusted gross income increase?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock