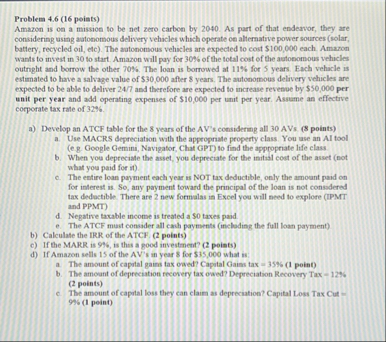

Question: Problem 4 . 6 ( 1 6 points ) Amazon is on a mission to be net zero carbon by 2 0 4 0 .

Problem points

Amazon is on a mission to be net zero carbon by As part of that endeavor, they are considering using autonomous delivery vehicles which operate on alternative power sources solar battery, recycled oil, etc The autonomous vehicles are expected to cost $ each. Amazon wants to invest in to start. Amazon will pay for of the total cost of the autonomous vehicles outnight and borrow the other The loan is borrowed at for years. Each vehicle is estimated to have a salvage value of $ after $ years. The autonomous delivery vehicles are expected to be able to deliver and therefore are expected to increase revenue by $per unit per year and add operating expenses of $ per unit per year. Assume an effectrve corporate tax rate of

a Develop an ATCF table for the years of the AV's considering all AVs points

a Use MACRS depreciation with the appropriate property class. You use an AI tool eg Ooogle Gemini, Navigator, Chat GPT to find the appropriate life class

b When you depreciate the asset, you depreciate for the initial cout of the asset not what you paid for it

c The entire loan payment each year as NOT tax deductible, only the amount paid on for interest is So any payment toward the principal of the loan is not considered tax dedoctible. There are new formulas in Excel you will need to explore IPMT and PPMT

d Negative taxable income is treated a taxes paid

e The ATCF must consider all cash payments incloding the full loan payment

b Calculate the IRR of the ATCF. points

c If the MARR is is this a good investment" points

d If Amazon sells of the AV's in year for $ what is:

a The amount of capital gains tax owed? Capital Gains tax point

b The amount of depreciation recovery tax owed? Depreciation Recovery Tax points

c The amount of capital loss they can claim as depreciation? Capital Loss Tax Cut point

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock