Question: Problem 4 . ( All cash flows in this problem are in thousands of dollars ) World Airways is considering acquisition of an additional airplane

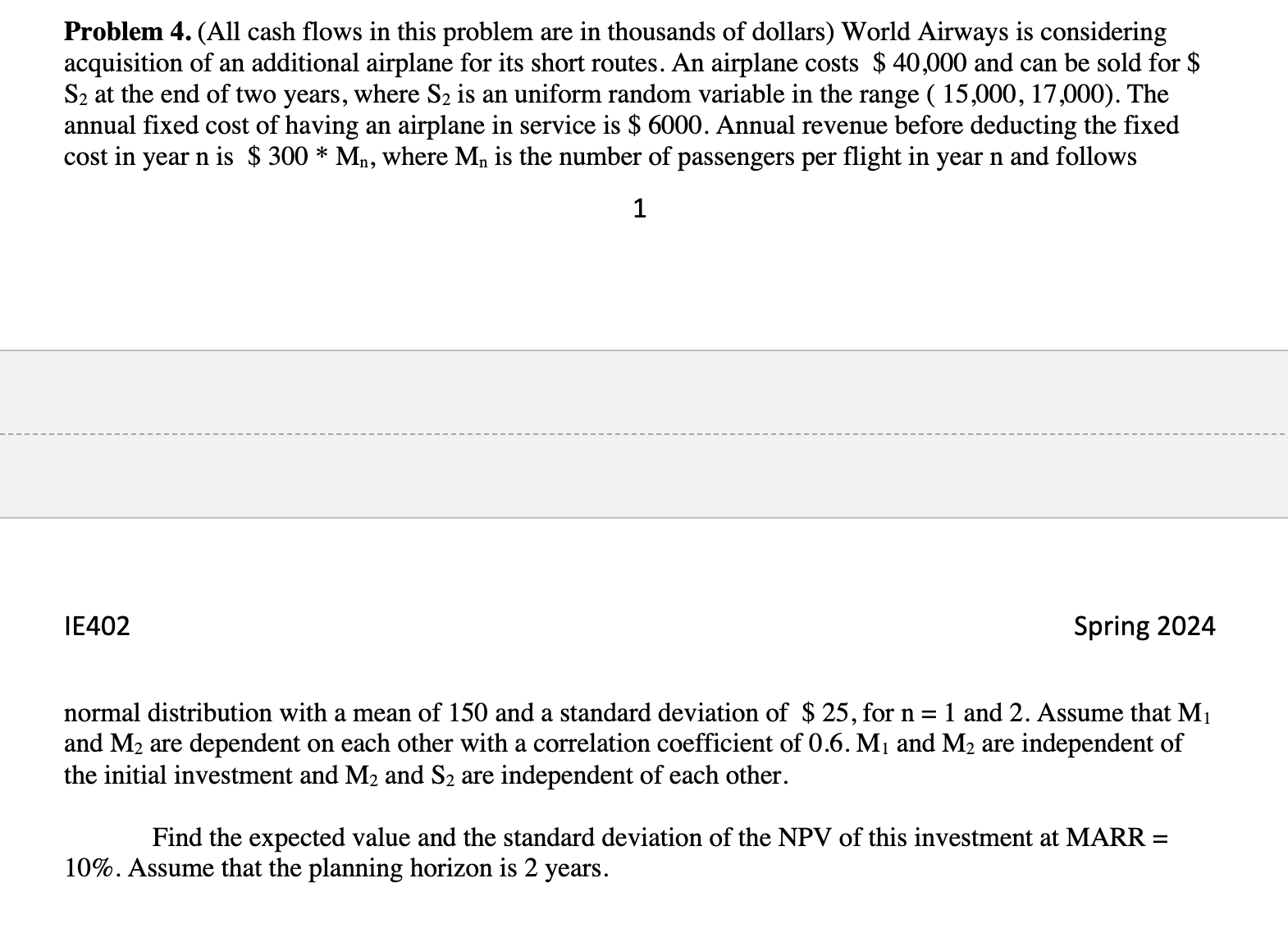

Problem All cash flows in this problem are in thousands of dollars World Airways is considering

acquisition of an additional airplane for its short routes. An airplane costs $ and can be sold for $

at the end of two years, where is an uniform random variable in the range The

annual fixed cost of having an airplane in service is $ Annual revenue before deducting the fixed

cost in year is $ where is the number of passengers per flight in year and follows

IE

Spring

normal distribution with a mean of and a standard deviation of $ for and Assume that

and are dependent on each other with a correlation coefficient of and are independent of

the initial investment and and are independent of each other.

Find the expected value and the standard deviation of the NPV of this investment at MARR

Assume that the planning horizon is years.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock