Question: Problem 4: Consider a 5-year Coupon Bond with a face and maturity value of $100, a coupon rate of 6% per annum payable semiannually and

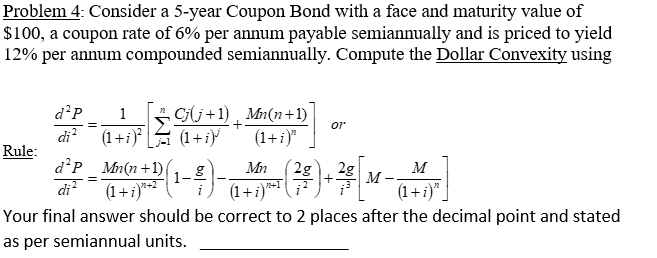

Problem 4: Consider a 5-year Coupon Bond with a face and maturity value of $100, a coupon rate of 6% per annum payable semiannually and is priced to yield 12% per annum compounded semiannually. Compute the Dollar Convexity using di2d2P=(1+i)21[j=1n(1+i)jCj(j+1)+(1+i)nMn(n+1)] or Rule: di2d2P=(1+i)n+2Mn(n+1)(1ig)(1+i)n+1Mn(i22g)+i32g[M(1+i)nM] Your final answer should be correct to 2 places after the decimal point and stated as per semiannual units. Problem 4: Consider a 5-year Coupon Bond with a face and maturity value of $100, a coupon rate of 6% per annum payable semiannually and is priced to yield 12% per annum compounded semiannually. Compute the Dollar Convexity using di2d2P=(1+i)21[j=1n(1+i)jCj(j+1)+(1+i)nMn(n+1)] or Rule: di2d2P=(1+i)n+2Mn(n+1)(1ig)(1+i)n+1Mn(i22g)+i32g[M(1+i)nM] Your final answer should be correct to 2 places after the decimal point and stated as per semiannual units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts