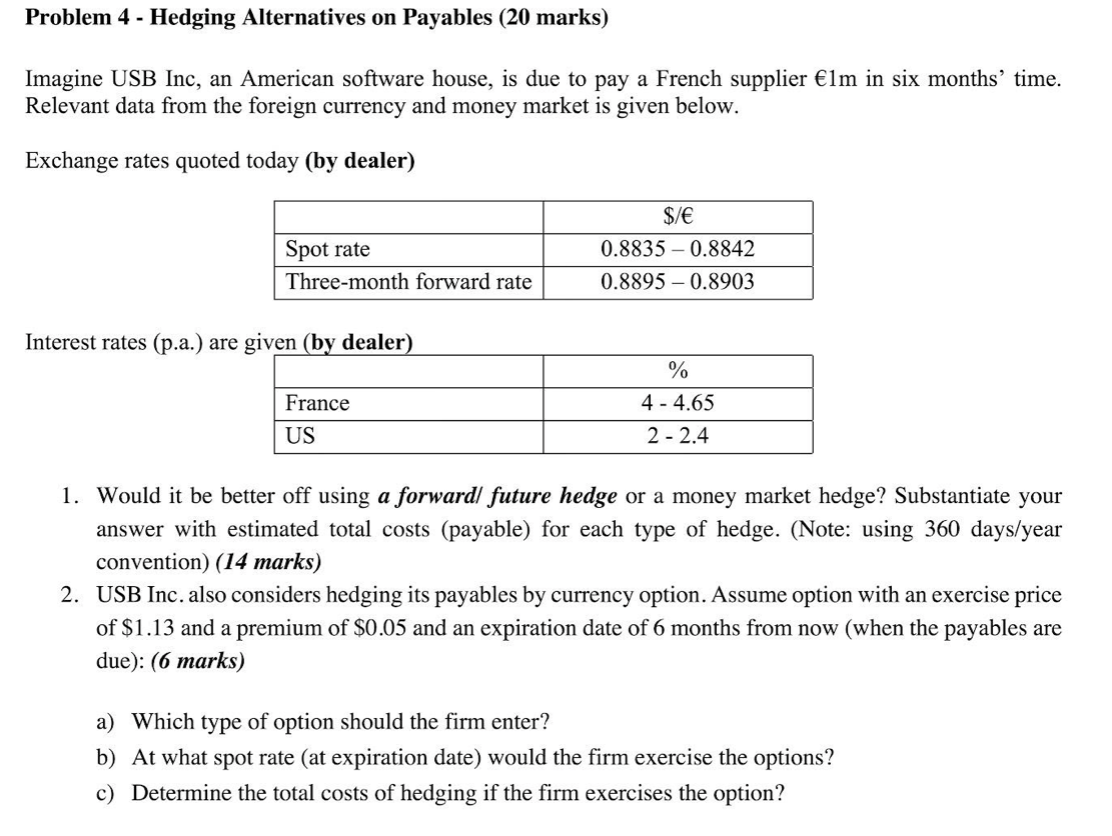

Question: Problem 4 - Hedging Alternatives on Payables (20 marks) six months' time. Imagine USB Inc, an American software house, is due to pay a French

Problem 4 - Hedging Alternatives on Payables (20 marks) six months' time. Imagine USB Inc, an American software house, is due to pay a French supplier Elm Relevant data from the foreign currency and money market is given below. Exchange rates quoted today (by dealer) Spot rate Three-month forward rate $/ 0.8835-0.8842 0.8895 - 0.8903 Interest rates (p.a.) are given (by dealer) % France US 4 - 4.65 2 - 2.4 1. Would it be better off using a forward/ future hedge or a money market hedge? Substantiate your answer with estimated total costs (payable) for each type of hedge. (Note: using 360 days/year convention) (14 marks) 2. USB Inc. also considers hedging its payables by currency option. Assume option with an exercise price of $1.13 and a premium of $0.05 and an expiration date of 6 months from now (when the payables are due): (6 marks) a) Which type of option should the firm enter? b) At what spot rate (at expiration date) would the firm exercise the options? c) Determine the total costs of hedging if the firm exercises the option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts