Question: Problem 4: Micca Metals, Inc. is a specialty materials and metals company located in Detroit, Michigan. The company specializes in specific precious metals and

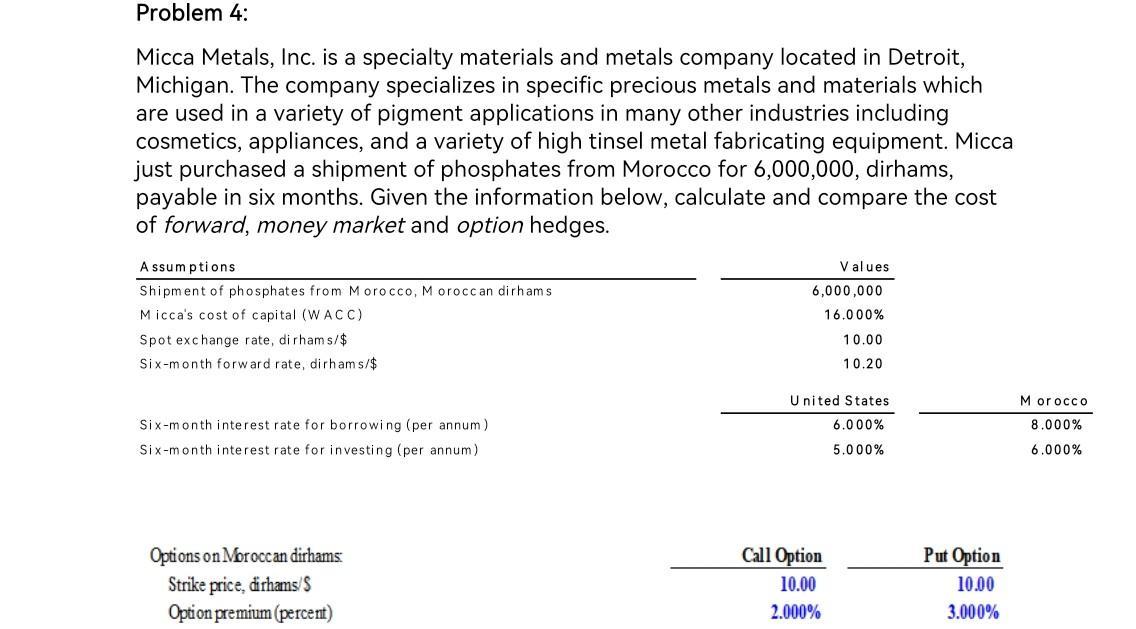

Problem 4: Micca Metals, Inc. is a specialty materials and metals company located in Detroit, Michigan. The company specializes in specific precious metals and materials which are used in a variety of pigment applications in many other industries including cosmetics, appliances, and a variety of high tinsel metal fabricating equipment. Micca just purchased a shipment of phosphates from Morocco for 6,000,000, dirhams, payable in six months. Given the information below, calculate and compare the cost of forward, money market and option hedges. Assumptions Shipment of phosphates from Morocco, Moroccan dirhams Micca's cost of capital (WACC) Spot exchange rate, dirhams/$ Six-month forward rate, dirhams/$ Six-month interest rate for borrowing (per annum) Six-month interest rate for investing (per annum). Options on Moroccan dirhams: Strike price, dirhams/S Option premium (percent) Values 6,000,000 16.000% Call Option 10.00 2.000% 10.00 10.20 United States 6.000% 5.000% Put Option 10.00 3.000% Morocco 8.000% 6.000%

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Answer Forward Market hedge Lets calculate the money involved in the forward market hedge first Th... View full answer

Get step-by-step solutions from verified subject matter experts