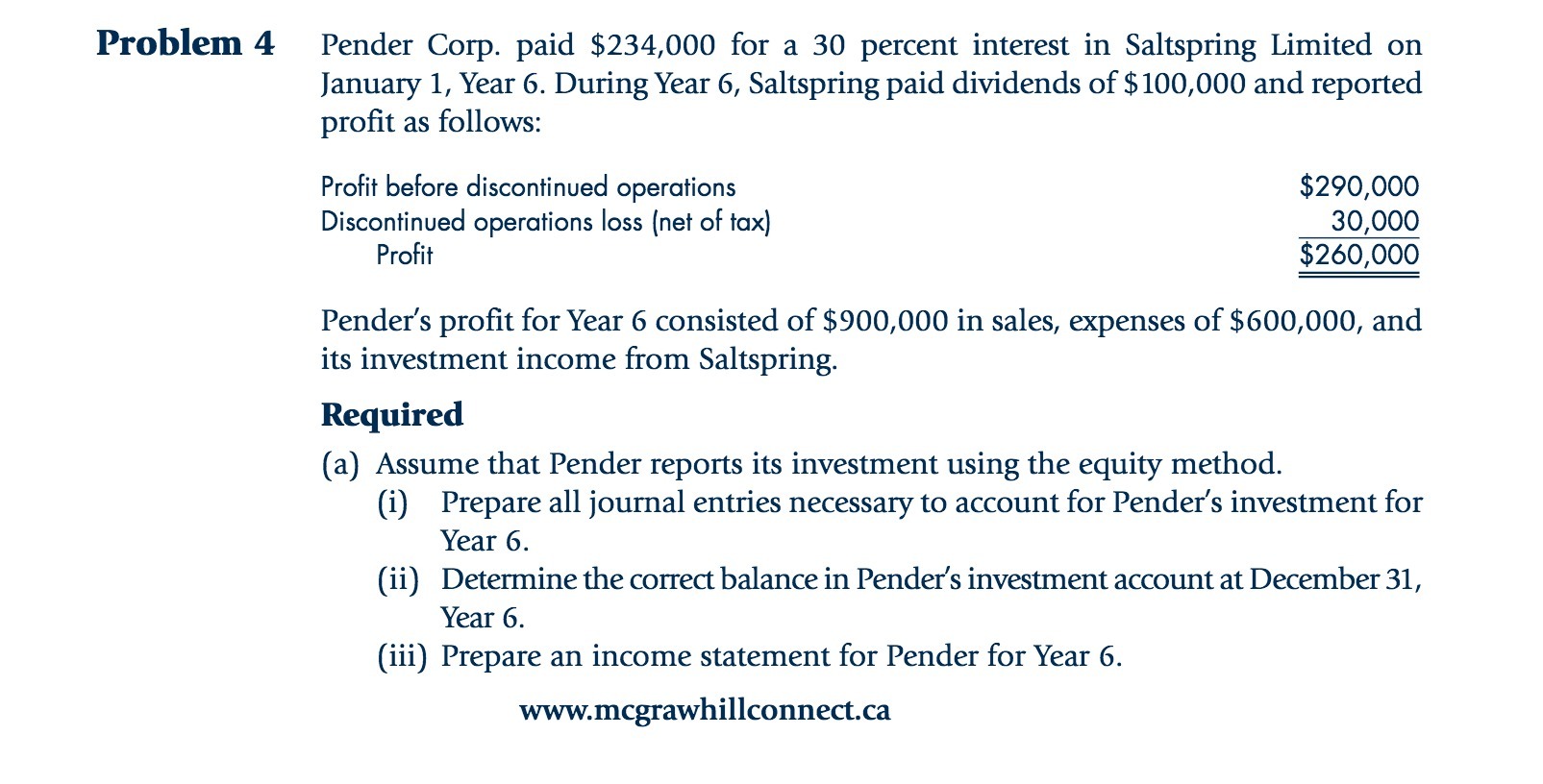

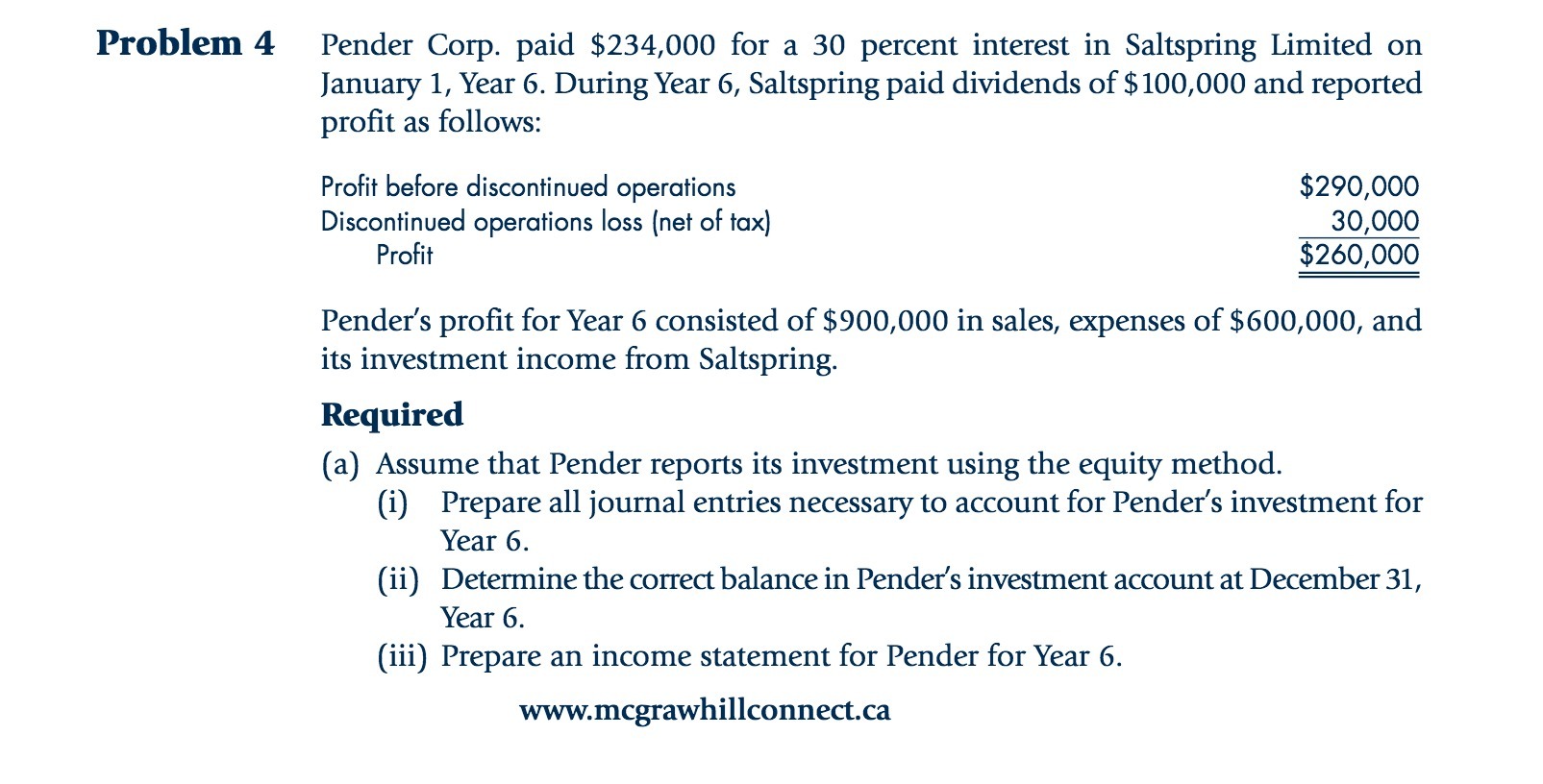

Question: Problem 4 Pender Corp . paid $234 ,000 for a 30 percent interest in Saltspring Limited on January 1 , Year 6 . During Year

Problem 4 Pender Corp . paid $234 ,000 for a 30 percent interest in Saltspring Limited on January 1 , Year 6 . During Year 6 , Saltspring paid dividends of $100 ,000 and reported profit as follows Profit before discontinued operatio $290, 000 Discontinued operations loss ( net of tax ) 30.000 Profit $260 000 Pender's profit for Year 6 consisted of $900 ,000 in sales , expenses of $600,000 , and its investment income from Saltspring Required ( a ) Assume that Pender report oIts its investment using the equity method ( 1 ) Prepare all journal entries necessary to account for Pender's investment fo Year G . ( 1 1 ) Determine the correct balance in Pender's investment account at December 3 Year G . ( 1 1 ) Prepare an income statement for Pender for Year 6 www . mcgrawhill connect . ca

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts