Question: Problem 4. Real options (25 points) All Inc. is considering a project which has two stages. The Firm may invest in the first stage only,

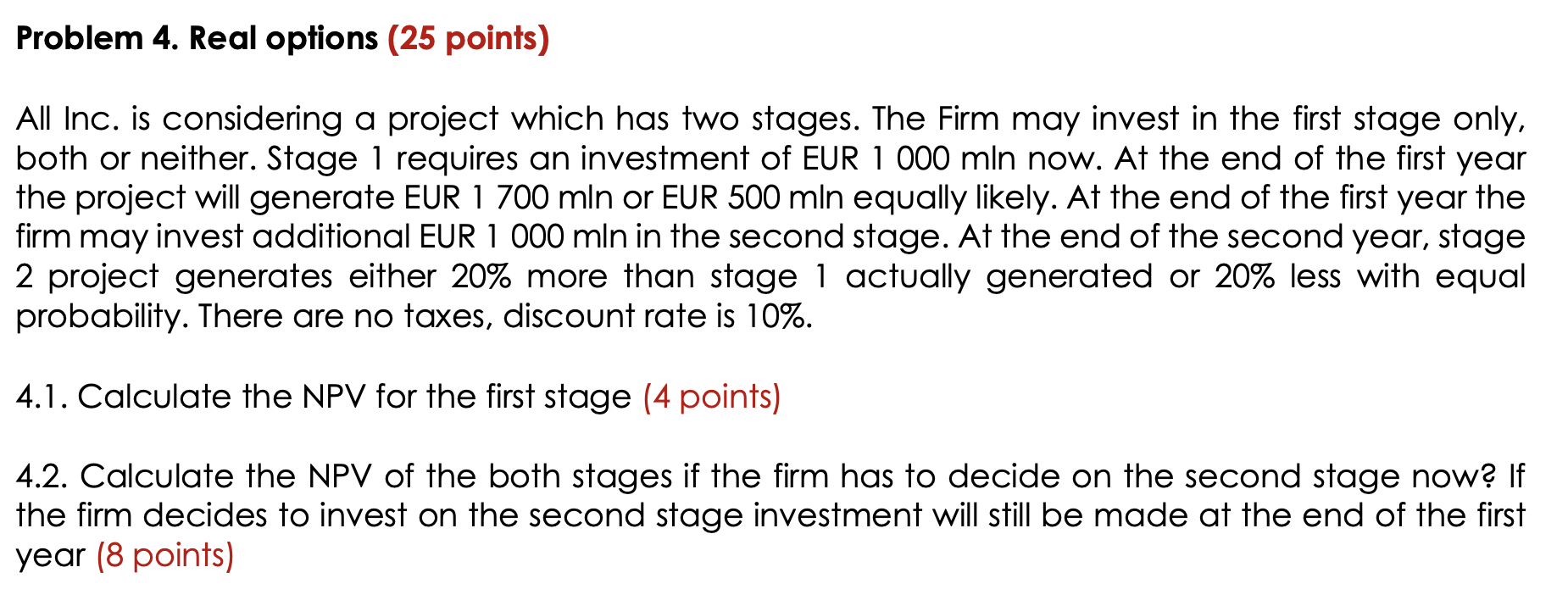

Problem 4. Real options (25 points) All Inc. is considering a project which has two stages. The Firm may invest in the first stage only, both or neither. Stage 1 requires an investment of EUR 1 000 mln now. At the end of the first year the project will generate EUR 1 700 mln or EUR 500 mln equally likely. At the end of the first year the firm may invest additional EUR 1 000 mln in the second stage. At the end of the second year, stage 2 project generates either 20% more than stage 1 actually generated or 20% less with equal probability. There are no taxes, discount rate is 10%. 4.1. Calculate the NPV for the first stage (4 points) 4.2. Calculate the NPV of the both stages if the firm has to decide on the second stage now? If the firm decides to invest on the second stage investment will still be made at the end of the first year (8 points) Problem 4. Real options (25 points) All Inc. is considering a project which has two stages. The Firm may invest in the first stage only, both or neither. Stage 1 requires an investment of EUR 1 000 mln now. At the end of the first year the project will generate EUR 1 700 mln or EUR 500 mln equally likely. At the end of the first year the firm may invest additional EUR 1 000 mln in the second stage. At the end of the second year, stage 2 project generates either 20% more than stage 1 actually generated or 20% less with equal probability. There are no taxes, discount rate is 10%. 4.1. Calculate the NPV for the first stage (4 points) 4.2. Calculate the NPV of the both stages if the firm has to decide on the second stage now? If the firm decides to invest on the second stage investment will still be made at the end of the first year (8 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts