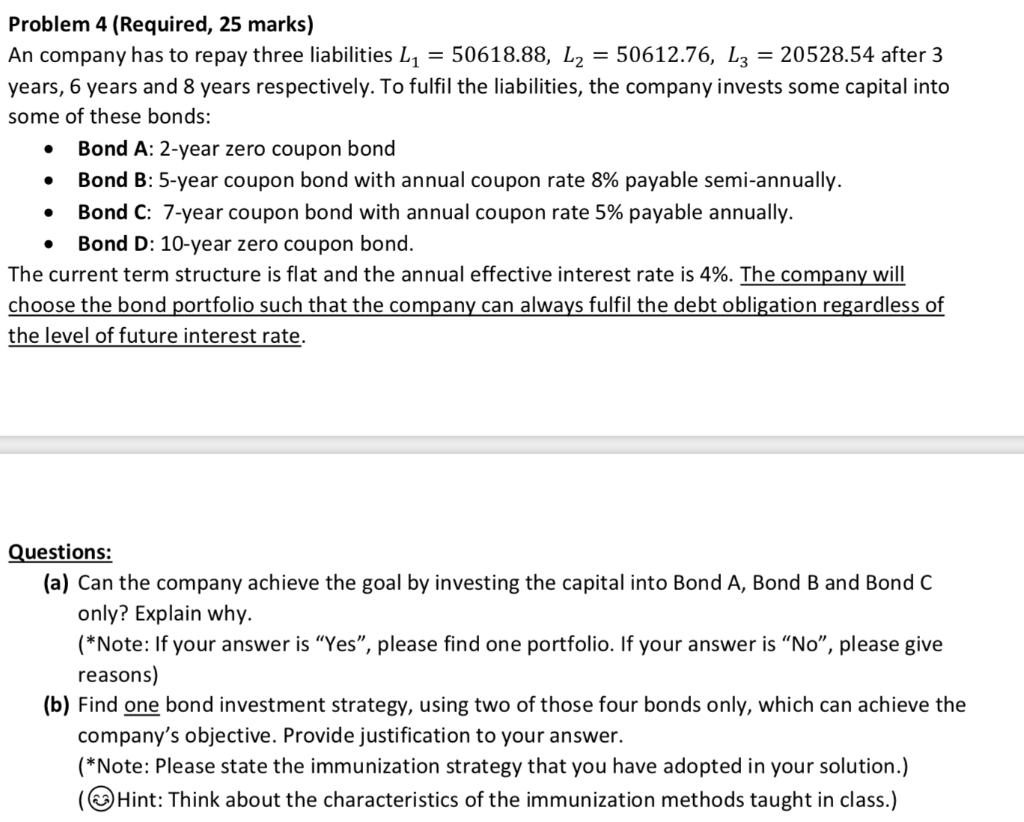

Question: Problem 4 (Required, 25 marks) An company has to repay three liabilities L1 = 50618.88, L2 50612.76, L3 = 20528.54 after 3 years, 6 years

Problem 4 (Required, 25 marks) An company has to repay three liabilities L1 = 50618.88, L2 50612.76, L3 = 20528.54 after 3 years, 6 years and 8 years respectively. To fulfil the liabilities, the company invests some capital into some of these bonds: Bond A: 2-year zero coupon bond Bond B: 5-year coupon bond with annual coupon rate 8% payable semi-annually. Bond C: 7-year coupon bond with annual coupon rate 5% payable annually. Bond D: 10-year zero coupon bond. The current term structure is flat and the annual effective interest rate is 4%. The company will choose the bond portfolio such that the company can always fulfil the debt obligation regardless of the level of future interest rate. . . Questions: (a) Can the company achieve the goal by investing the capital into Bond A, Bond B and Bond C only? Explain why. (*Note: If your answer is Yes, please find one portfolio. If your answer is No, please give reasons) (b) Find one bond investment strategy, using two of those four bonds only, which can achieve the company's objective. Provide justification to your answer. (*Note: Please state the immunization strategy that you have adopted in your solution.) (Hint: Think about the characteristics of the immunization methods taught in class.) Problem 4 (Required, 25 marks) An company has to repay three liabilities L1 = 50618.88, L2 50612.76, L3 = 20528.54 after 3 years, 6 years and 8 years respectively. To fulfil the liabilities, the company invests some capital into some of these bonds: Bond A: 2-year zero coupon bond Bond B: 5-year coupon bond with annual coupon rate 8% payable semi-annually. Bond C: 7-year coupon bond with annual coupon rate 5% payable annually. Bond D: 10-year zero coupon bond. The current term structure is flat and the annual effective interest rate is 4%. The company will choose the bond portfolio such that the company can always fulfil the debt obligation regardless of the level of future interest rate. . . Questions: (a) Can the company achieve the goal by investing the capital into Bond A, Bond B and Bond C only? Explain why. (*Note: If your answer is Yes, please find one portfolio. If your answer is No, please give reasons) (b) Find one bond investment strategy, using two of those four bonds only, which can achieve the company's objective. Provide justification to your answer. (*Note: Please state the immunization strategy that you have adopted in your solution.) (Hint: Think about the characteristics of the immunization methods taught in class.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts