Question: Problem 4 : Sensitive Projects A firm with required rate of return ( discount rate ) 1 6 % is evaluating a 1 0 -

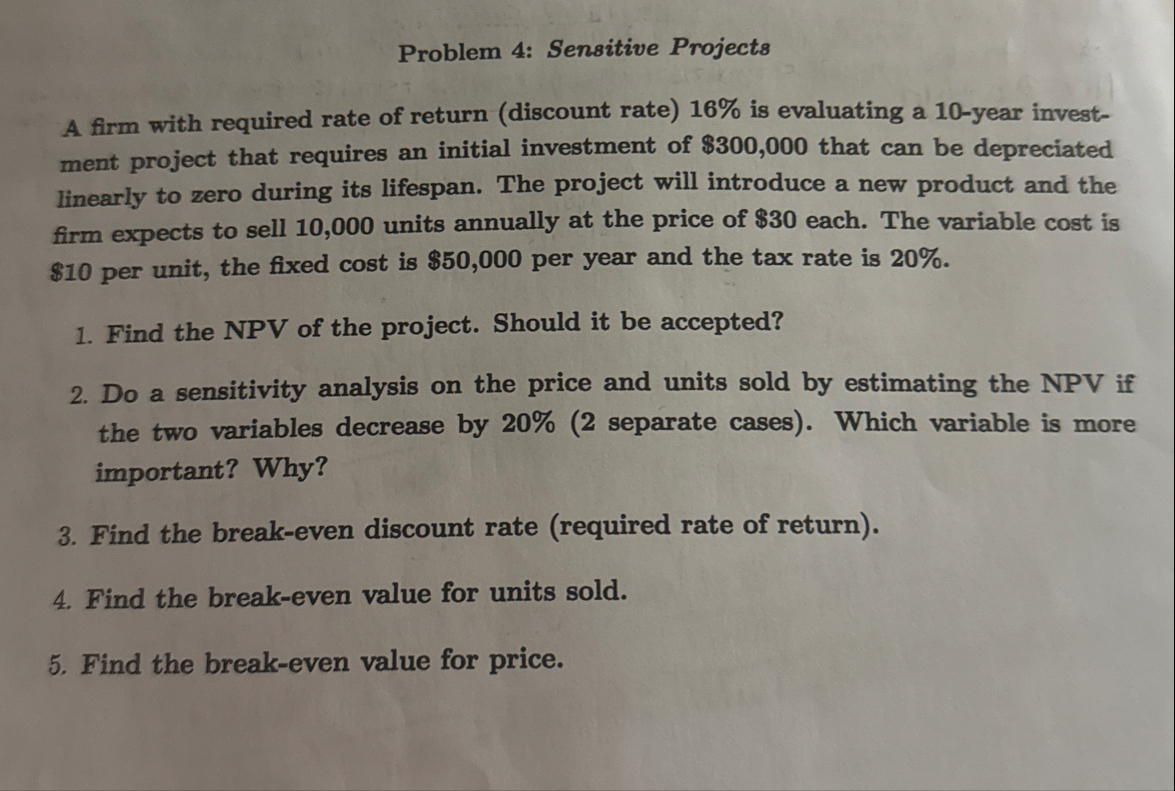

Problem : Sensitive Projects

A firm with required rate of return discount rate is evaluating a year investment project that requires an initial investment of $ that can be depreciated linearly to zero during its lifespan. The project will introduce a new product and the firm expects to sell units annually at the price of $ each. The variable cost is $ per unit, the fixed cost is $ per year and the tax rate is

Find the NPV of the project. Should it be accepted?

Do a sensitivity analysis on the price and units sold by estimating the NPV if the two variables decrease by separate cases Which variable is more important? Why?

Find the breakeven discount rate required rate of return

Find the breakeven value for units sold.

Find the breakeven value for price.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock