Question: Suppose that a country has negative net foreign assets and adopts a policy of running a trade balance surplus sufficient to repay a constant

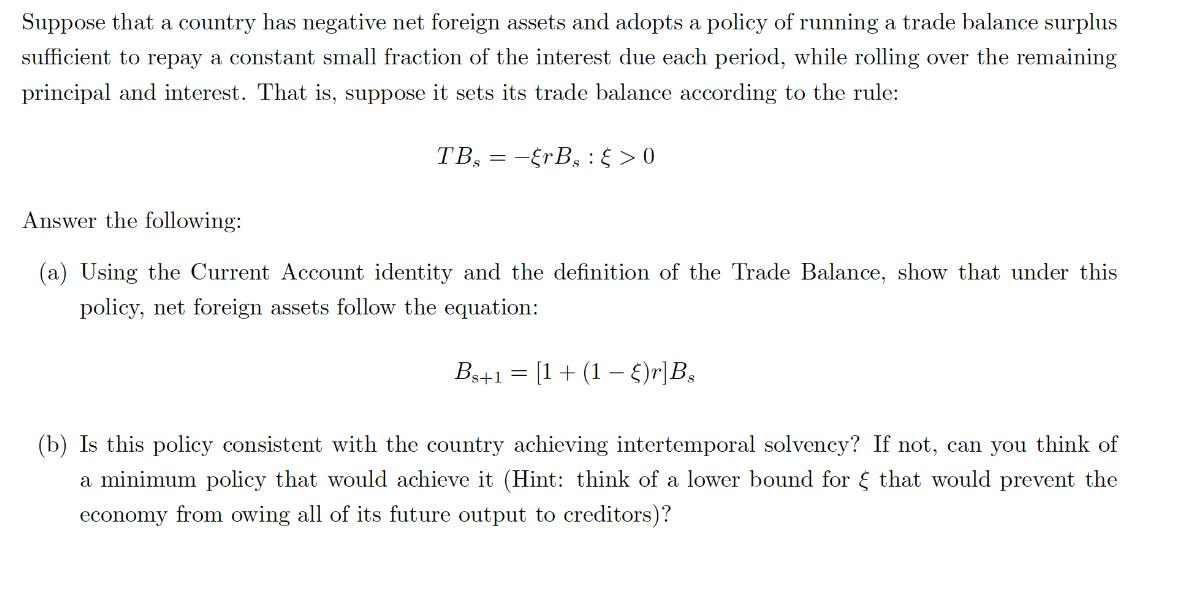

Suppose that a country has negative net foreign assets and adopts a policy of running a trade balance surplus sufficient to repay a constant small fraction of the interest due each period, while rolling over the remaining principal and interest. That is, suppose it sets its trade balance according to the rule: TB, ErB: >0 - Answer the following: (a) Using the Current Account identity and the definition of the Trade Balance, show that under this policy, net foreign assets follow the equation: Bs+1 = [1 + (1 - )r]B (b) Is this policy consistent with the country achieving intertemporal solvency? If not, can you think of a minimum policy that would achieve it (Hint: think of a lower bound for that would prevent the economy from owing all of its future output to creditors)?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts