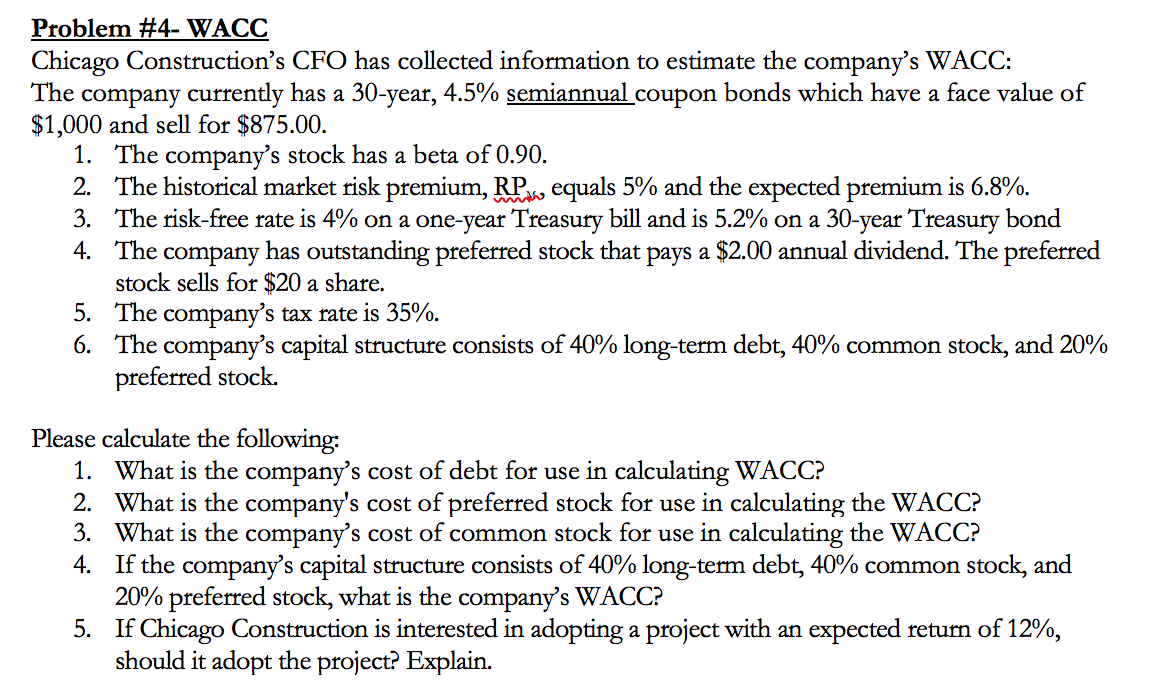

Question: Problem #4- WACC Chicago Constructions CFO has collected information to estimate the company's WACC: The company currently has a 30-year, 4.5% semiannual coupon bonds which

Problem #4- WACC Chicago Constructions CFO has collected information to estimate the company's WACC: The company currently has a 30-year, 4.5% semiannual coupon bonds which have a face value of $1,000 and sell for $875.00. 1. The company's stock has a beta of 0.90. 2. The historical market risk premium, RP w equals 5% and the expected premium is 6.8%. 3. The risk-free rate is 4% on a one-year Treasury bill and is 5.2% on a 30-year Treasury bond 4. The company has outstanding preferred stock that pays a $2.00 annual dividend. The preferred stock sells for $20 a share. 5. The company's tax rate is 35%. 6. The company's capital structure consists of 40% long-term debt, 40% common stock, and 20% preferred stock. Please calculate the following: 1. What is the company's cost of debt for use in calculating WACC? 2. What is the company's cost of preferred stock for use in calculating the WACC? 3. What is the company's cost of common stock for use in calculating the WACC? 4. If the company's capital structure consists of 40% long-term debt, 40% common stock, and 20% preferred stock, what is the company's WACC? 5. If Chicago Construction is interested in adopting a project with an expected return of 12%, should it adopt the project? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts