Question: Problem #4 What is the net present value of a project for Wolverine Enterprises that has an initial cash outflow of $52,500 and the following

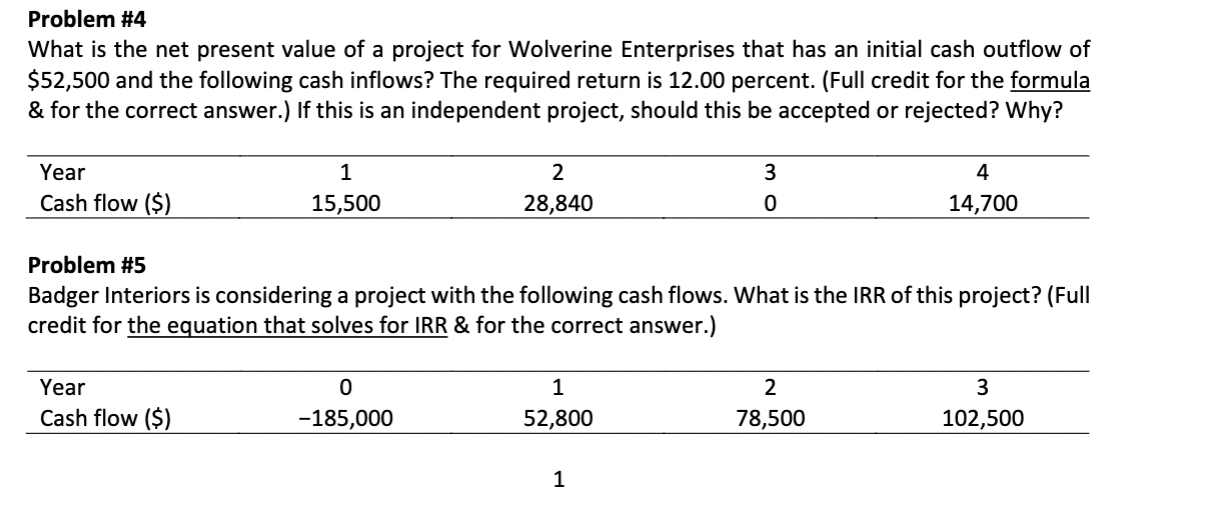

Problem #4 What is the net present value of a project for Wolverine Enterprises that has an initial cash outflow of $52,500 and the following cash inflows? The required return is 12.00 percent. (Full credit for the formula & for the correct answer.) If this is an independent project, should this be accepted or rejected? Why? Year Cash flow ($) 1 15,500 2 28,840 3 0 4 14,700 Problem #5 Badger Interiors is considering a project with the following cash flows. What is the IRR of this project? (Full credit for the equation that solves for IRR & for the correct answer.) 0 2. Year Cash flow ($) 1 52,800 3 102,500 -185,000 78,500 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts