Question: Problem 4. You are given the following information. The current price of the stock index is S = 80. The continuously compounded interest rate is

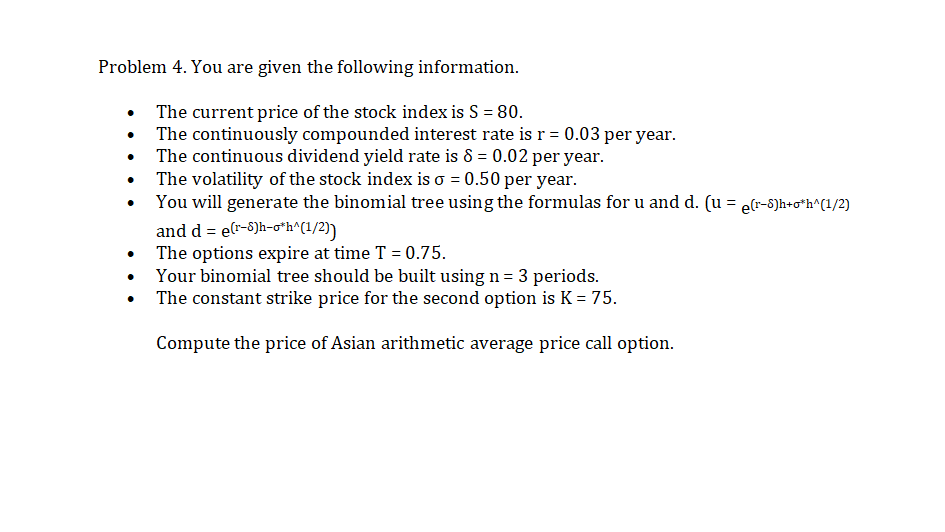

Problem 4. You are given the following information. The current price of the stock index is S = 80. The continuously compounded interest rate is r = 0.03 per year. The continuous dividend yield rate is 8 = 0.02 per year. The volatility of the stock index is o = 0.50 per year. You will generate the binomial tree using the formulas for u and d. (u = elr-S)h+o*h^(1/2) and d = e(r-8)h-o*h^(1/2)) The options expire at time T = 0.75. Your binomial tree should be built using n= 3 periods. The constant strike price for the second option is K = 75. Compute the price of Asian arithmetic average price call option. Problem 4. You are given the following information. The current price of the stock index is S = 80. The continuously compounded interest rate is r = 0.03 per year. The continuous dividend yield rate is 8 = 0.02 per year. The volatility of the stock index is o = 0.50 per year. You will generate the binomial tree using the formulas for u and d. (u = elr-S)h+o*h^(1/2) and d = e(r-8)h-o*h^(1/2)) The options expire at time T = 0.75. Your binomial tree should be built using n= 3 periods. The constant strike price for the second option is K = 75. Compute the price of Asian arithmetic average price call option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts