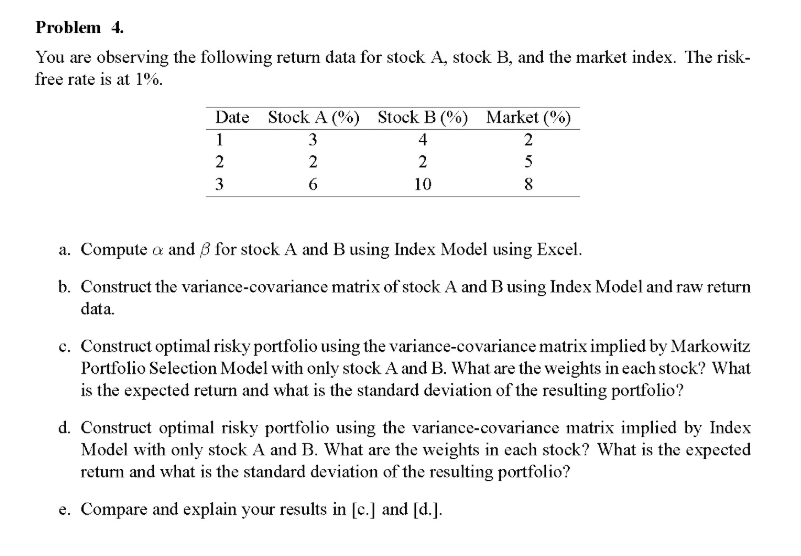

Question: Problem 4. You are observing the following return data for stock A, stock B, and the market index. The risk- free rate is at 1%.

Problem 4. You are observing the following return data for stock A, stock B, and the market index. The risk- free rate is at 1%. Date Stock A (%) Stock B (%) Market (%) 1 3 4 2 2 2 2 5 3 6 10 8 a. Computea and B for stock A and B using Index Model using Excel. b. Construct the variance-covariance matrix of stock A and B using Index Model and raw return data. c. Construct optimal risky portfolio using the variance-covariance matrix implied by Markowitz Portfolio Selection Model with only stock A and B. What are the weights in each stock? What is the expected return and what is the standard deviation of the resulting portfolio? d. Construct optimal risky portfolio using the variance-covariance matrix implied by Index Model with only stock A and B. What are the weights in each stock? What is the expected return and what is the standard deviation of the resulting portfolio? e. Compare and explain your results in (c.] and [d.). Problem 4. You are observing the following return data for stock A, stock B, and the market index. The risk- free rate is at 1%. Date Stock A (%) Stock B (%) Market (%) 1 3 4 2 2 2 2 5 3 6 10 8 a. Computea and B for stock A and B using Index Model using Excel. b. Construct the variance-covariance matrix of stock A and B using Index Model and raw return data. c. Construct optimal risky portfolio using the variance-covariance matrix implied by Markowitz Portfolio Selection Model with only stock A and B. What are the weights in each stock? What is the expected return and what is the standard deviation of the resulting portfolio? d. Construct optimal risky portfolio using the variance-covariance matrix implied by Index Model with only stock A and B. What are the weights in each stock? What is the expected return and what is the standard deviation of the resulting portfolio? e. Compare and explain your results in (c.] and [d.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts