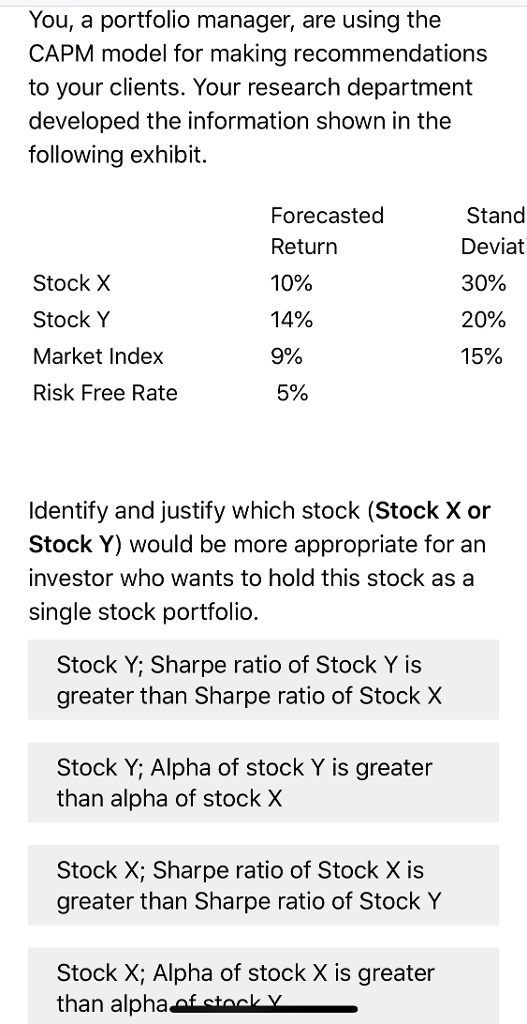

Question: You, a portfolio manager, are using the CAPM model for making recommendations to your clients. Your research department developed the information shown in the following

You, a portfolio manager, are using the CAPM model for making recommendations to your clients. Your research department developed the information shown in the following exhibit. Stock X Stock Y Market Index Risk Free Rate Forecasted Return 10% 14% 9% 5% Stand Deviat 30% 20% 15% Identify and justify which stock (Stock X or Stock Y) would be more appropriate for an investor who wants to hold this stock as a single stock portfolio. Stock Y; Sharpe ratio of Stock Y is greater than Sharpe ratio of Stock X Stock Y; Alpha of stock Y is greater than alpha of stock X Stock X; Sharpe ratio of Stock X is greater than Sharpe ratio of Stock Y Stock X; Alpha of stock X is greater than alpha

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts