Question: Problem 4: You have been asked to create a synthetic short position in a forward contract that permits you to sell 10 units of the

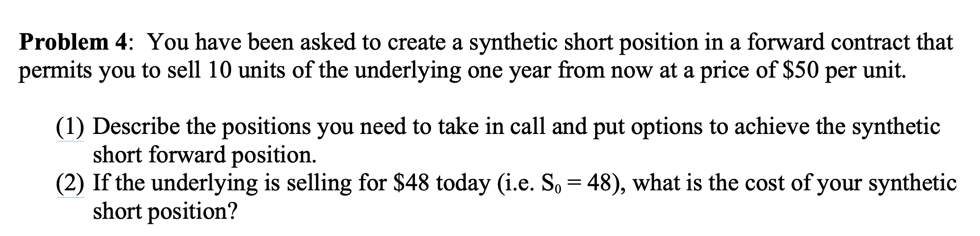

Problem 4: You have been asked to create a synthetic short position in a forward contract that permits you to sell 10 units of the underlying one year from now at a price of $50 per unit. (1) Describe the positions you need to take in call and put options to achieve the synthetic short forward position. (2) If the underlying is selling for $48 today (i.e. So = 48), what is the cost of your synthetic short position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts