Question: Problem 4. Your uncle, Larson E. Whipsnade, has asked you for some financial advice. His retirement savings are currently invested as follows: $20,000 in the

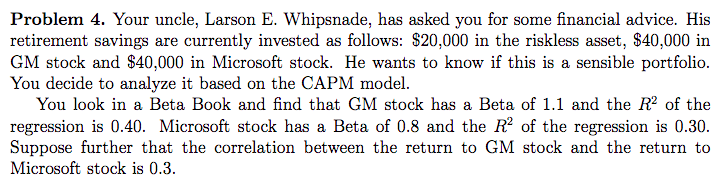

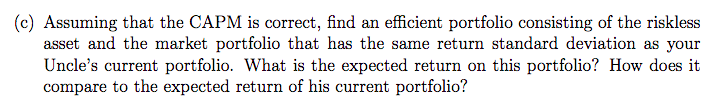

Problem 4. Your uncle, Larson E. Whipsnade, has asked you for some financial advice. His retirement savings are currently invested as follows: $20,000 in the riskless asset, $40,000 in GM stock and $40,000 in Microsoft stock. He wants to know if this is a sensible portfolio. You decide to analyze it based on the CAPM model. You look in a Beta Book and find that GM stock has a Beta of 1.1 and the R2 of the regression is 0.40. Microsoft stock has a Beta of 0.8 and the R of the regression is 0.30. Suppose further that the correlation between the return to GM stock and the return to Microsoft stock is 0.3. (c) Assuming that the CAPM is correct, find an efficient portfolio consisting of the riskless asset and the market portfolio that has the same return standard deviation as your Uncle's current portfolio. What is the expected return on this portfolio? How does it compare to the expected return of his current portfolio? Problem 4. Your uncle, Larson E. Whipsnade, has asked you for some financial advice. His retirement savings are currently invested as follows: $20,000 in the riskless asset, $40,000 in GM stock and $40,000 in Microsoft stock. He wants to know if this is a sensible portfolio. You decide to analyze it based on the CAPM model. You look in a Beta Book and find that GM stock has a Beta of 1.1 and the R2 of the regression is 0.40. Microsoft stock has a Beta of 0.8 and the R of the regression is 0.30. Suppose further that the correlation between the return to GM stock and the return to Microsoft stock is 0.3. (c) Assuming that the CAPM is correct, find an efficient portfolio consisting of the riskless asset and the market portfolio that has the same return standard deviation as your Uncle's current portfolio. What is the expected return on this portfolio? How does it compare to the expected return of his current portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts