Question: Your uncle. Larson E. Whipsnade, has asked you for some financial advice. His retirement savings are currently invested as follows: $30,000 in the risk-free asset

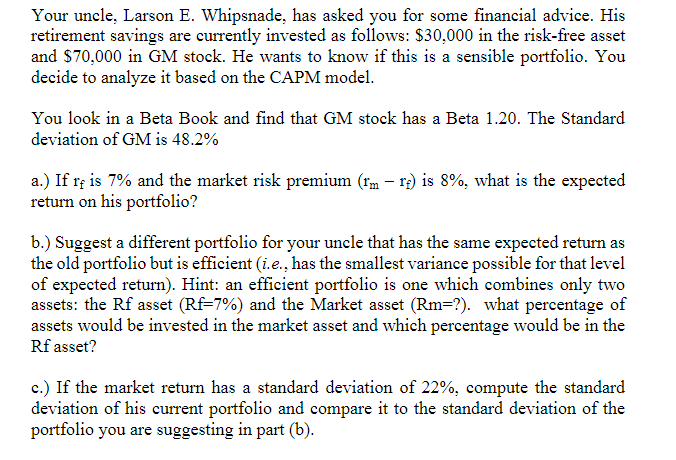

Your uncle. Larson E. Whipsnade, has asked you for some financial advice. His retirement savings are currently invested as follows: $30,000 in the risk-free asset and $70,000 in GM stock. He wants to know if this is a sensible portfolio. You decide to analyze it based on the CAPM model. You look in a Beta Book and find that GM stock has a Beta 1.20. The Standard deviation of GM is 48.2% a.) If r is 7% and the market risk premium (im re) is 8%, what is the expected return on his portfolio? b.) Suggest a different portfolio for your uncle that has the same expected return as the old portfolio but is efficient (i.e., has the smallest variance possible for that level of expected return). Hint: an efficient portfolio is one which combines only two assets: the Rf asset (RF=7%) and the Market asset (Rm=?). what percentage of assets would be invested in the market asset and which percentage would be in the Rf asset? c.) If the market return has a standard deviation of 22%, compute the standard deviation of his current portfolio and compare it to the standard deviation of the portfolio you are suggesting in part (b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts