Question: Problem 4-107 (algorithmic) Question Help The monthly income from a piece of commercial property is $1,200 (paid as a lump sum and $1,000 for property

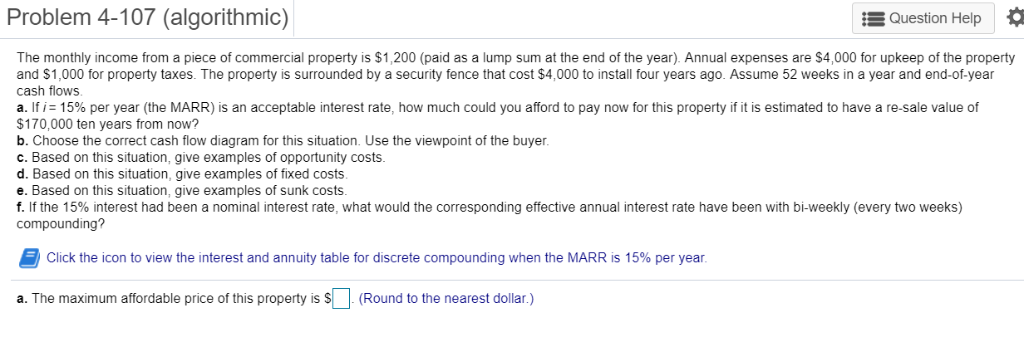

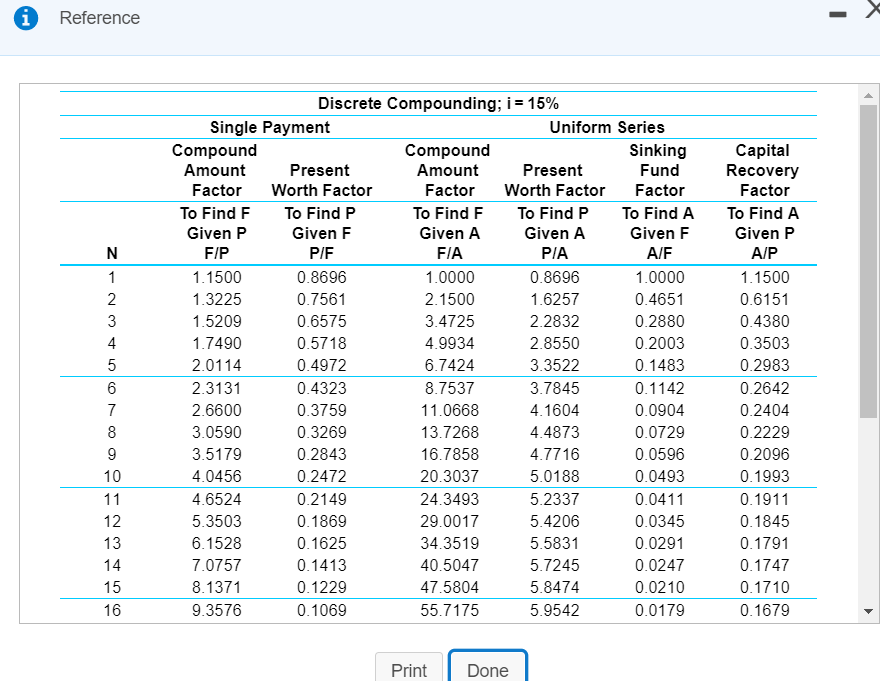

Problem 4-107 (algorithmic) Question Help The monthly income from a piece of commercial property is $1,200 (paid as a lump sum and $1,000 for property taxes. The property is surrounded by a security fence that cost $4,000 to install four years ago. Assume 52 weeks in a year and end-of-year cash flows t the end of the year). Annual expenses are $4,000 for upkeep of the property a. Ifi 15% per year (the MARR) is an acceptable interest rate, how much could you afford to pay now for this property if it is estimated to have a re-sale value of $170,000 ten years from now? b. Choose the correct cash flow diagram for this situation. Use the viewpoint of the buyer. c. Based on this situation, give examples of opportunity costs. d. Based on this situation, give examples of fixed costs. e. Based on this situation, give examples of sunk costs f. If the 15% interest had been a nominal interest rate, what would the corresponding effective annual interest rate have been with bi-weekly (every two weeks) compounding? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15% per year. a. The maximum affordable price of this property is S (Round to the nearest dollar.) Reference Discrete Compounding; i 15% Uniform Series Single Payment Capital Recovery Compound Amount Sinking Fund Compound Amount Present Present Worth Factor Factor Worth Factor Factor Factor Factor To Find F To Find P To Find P Given A To Find A To Find A To Find F Given P Given F Given A Given F Given P F/P P/F F/A P/A A/F A/P 1 1.1500 0.8696 1.0000 0.8696 1.0000 1.1500 0.4651 2 1.3225 0.7561 2.1500 1.6257 0.6151 3 2.2832 0.4380 1.5209 0.6575 3.4725 0.2880 1.7490 0.5718 0.3503 4.9934 2.8550 0.2003 3.3522 2.0114 0.4972 6.7424 0.1483 0.2983 2.3131 3.7845 0.1142 0.2642 0.4323 8.7537 7 0.3759 2.6600 11.0668 4.1604 0.0904 0.2404 0.3269 3.0590 13.7268 4.4873 0.0729 0.2229 9 0.2096 3.5179 0.2843 16.7858 4.7716 0.0596 0.0493 4.0456 0.1993 10 0.2472 20.3037 5.0188 5.2337 11 4.6524 0.2149 24.3493 0.0411 0.1911 5.4206 12 5.3503 0.1869 29.0017 0.0345 0.1845 0.0291 0.1791 13 6.1528 0.1625 34.3519 5.5831 0.0247 0.1747 14 7.0757 0.1413 40.5047 5.7245 0.1229 47.5804 5.8474 0.0210 15 8.1371 0.1710 0.1069 5.9542 0.1679 16 9.3576 55.7175 0.0179 Print Done LO Problem 4-107 (algorithmic) Question Help The monthly income from a piece of commercial property is $1,200 (paid as a lump sum and $1,000 for property taxes. The property is surrounded by a security fence that cost $4,000 to install four years ago. Assume 52 weeks in a year and end-of-year cash flows t the end of the year). Annual expenses are $4,000 for upkeep of the property a. Ifi 15% per year (the MARR) is an acceptable interest rate, how much could you afford to pay now for this property if it is estimated to have a re-sale value of $170,000 ten years from now? b. Choose the correct cash flow diagram for this situation. Use the viewpoint of the buyer. c. Based on this situation, give examples of opportunity costs. d. Based on this situation, give examples of fixed costs. e. Based on this situation, give examples of sunk costs f. If the 15% interest had been a nominal interest rate, what would the corresponding effective annual interest rate have been with bi-weekly (every two weeks) compounding? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15% per year. a. The maximum affordable price of this property is S (Round to the nearest dollar.) Reference Discrete Compounding; i 15% Uniform Series Single Payment Capital Recovery Compound Amount Sinking Fund Compound Amount Present Present Worth Factor Factor Worth Factor Factor Factor Factor To Find F To Find P To Find P Given A To Find A To Find A To Find F Given P Given F Given A Given F Given P F/P P/F F/A P/A A/F A/P 1 1.1500 0.8696 1.0000 0.8696 1.0000 1.1500 0.4651 2 1.3225 0.7561 2.1500 1.6257 0.6151 3 2.2832 0.4380 1.5209 0.6575 3.4725 0.2880 1.7490 0.5718 0.3503 4.9934 2.8550 0.2003 3.3522 2.0114 0.4972 6.7424 0.1483 0.2983 2.3131 3.7845 0.1142 0.2642 0.4323 8.7537 7 0.3759 2.6600 11.0668 4.1604 0.0904 0.2404 0.3269 3.0590 13.7268 4.4873 0.0729 0.2229 9 0.2096 3.5179 0.2843 16.7858 4.7716 0.0596 0.0493 4.0456 0.1993 10 0.2472 20.3037 5.0188 5.2337 11 4.6524 0.2149 24.3493 0.0411 0.1911 5.4206 12 5.3503 0.1869 29.0017 0.0345 0.1845 0.0291 0.1791 13 6.1528 0.1625 34.3519 5.5831 0.0247 0.1747 14 7.0757 0.1413 40.5047 5.7245 0.1229 47.5804 5.8474 0.0210 15 8.1371 0.1710 0.1069 5.9542 0.1679 16 9.3576 55.7175 0.0179 Print Done LO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts