Question: Problem 4-15 (Algorithmic) (LO. 2) Al is a physician who conducts his practice as a sole proprietor. During 2019, he received cash of $558,400 for

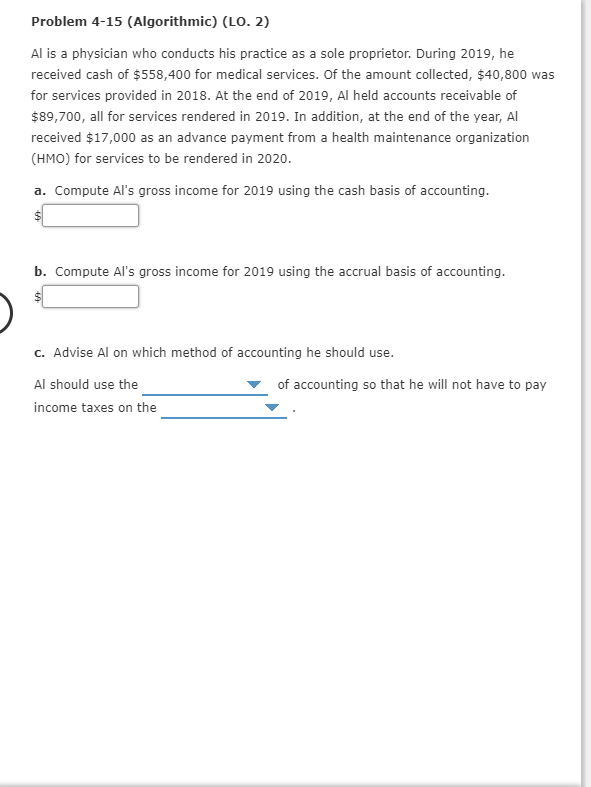

Problem 4-15 (Algorithmic) (LO. 2) Al is a physician who conducts his practice as a sole proprietor. During 2019, he received cash of $558,400 for medical services. Of the amount collected, $40,800 was for services provided in 2018. At the end of 2019, Al held accounts receivable of $89,700, all for services rendered in 2019. In addition, at the end of the year, Al received $17,000 as an advance payment from a health maintenance organization (HMO) for services to be rendered in 2020. a. Compute Al's gross income for 2019 using the cash basis of accounting. $ b. Compute Al's gross income for 2019 using the accrual basis of accounting. C. Advise Al on which method of accounting he should use. Al should use the of accounting so that he will not have to pay income taxes on the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts