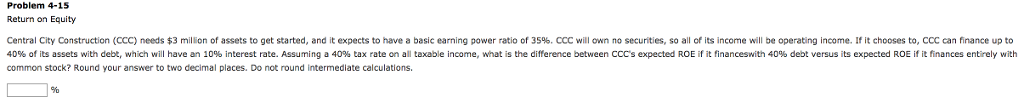

Question: Problem 4-15 Return on Equity a basic earning power ratio of 3596 Central City Construction CCC needs $3 million of assets to get started, and

Problem 4-15 Return on Equity a basic earning power ratio of 3596 Central City Construction CCC needs $3 million of assets to get started, and it expects to have . CCC will own no securities, so all of its income will b operating income. If it chooses to CCC can finance up to 40% of its assets with debt, which will have an 10% interest rate. Assuming a 40% tax rate on all taxable income, what is the difference between CCC's expected ROE i it finances ith 40% debt versus its expected ROE ifit nances entire y with common stock? Round your answer to two decimal places. Do not round intermediate calculations. pected ROE ifit financeswith

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts