Question: Problem 4.2 (15.30 in Hull) Consider an option on a non-dividend-paying stock when the stock price is $30, the exercise price is $29, the risk-free

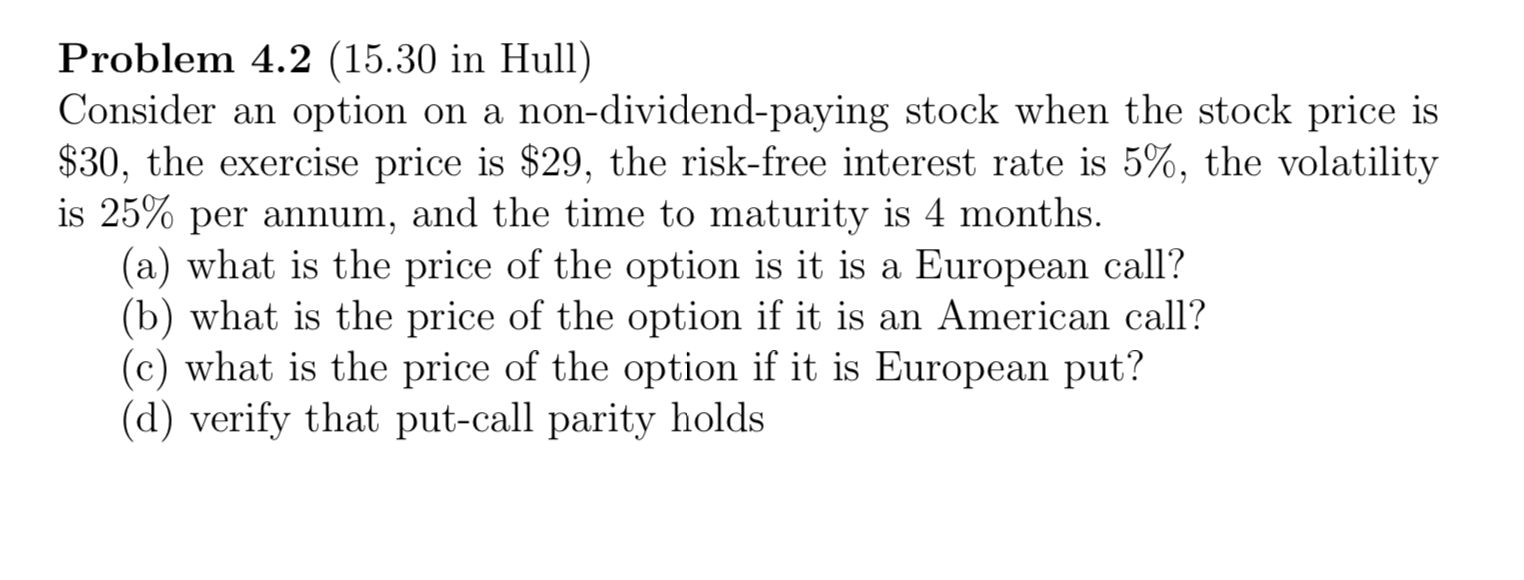

Problem 4.2 (15.30 in Hull) Consider an option on a non-dividend-paying stock when the stock price is $30, the exercise price is $29, the risk-free interest rate is 5%, the volatility is 25% per annum, and the time to maturity is 4 months. (a) what is the price of the option is it is a European call? (b) what is the price of the option if it is an American call? (c) what is the price of the option if it is European put? (d) verify that put-call parity holds

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock