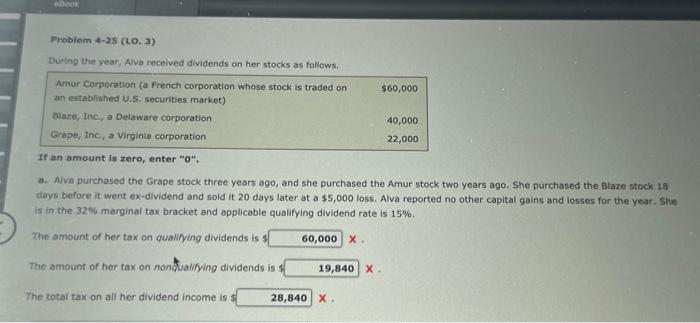

Question: Problem 4-25 (LO. 3) During the vear, Ava received dividends on her stocks as follows. If an amount is zero, enter 0 . a.

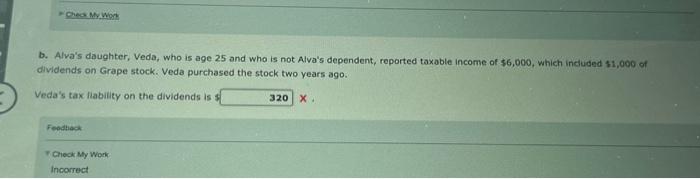

Problem 4-25 (LO. 3) During the vear, Ava received dividends on her stocks as follows. If an amount is zero, enter " 0 ". a. Ava purchased the Grape stock three years ago, and she purchased the Amur stock two years ago. She purchased the Btaze stock 18 days before it went ex-dividend and sold it 20 days later at a $5,000 loss. Alva reported no other capital gains and losses for the year. She is in the 32% marginal tax bracket and applicable qualifying dividend rate is 15%. The amount of her tax on qualifying dividends is 5 x. The amount of her tax on nondualifying dividends is s The total tax on all her dividend income is \$ x. b. Alva's daughter, Veda, who is age 25 and who is not Alva's dependent, reported taxable income of $6,000, which induded $1,000 of dividends on Grape stock. Veda purchased the stock two years ago. Veda's tax fiability on the dividends is x. Check My Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts