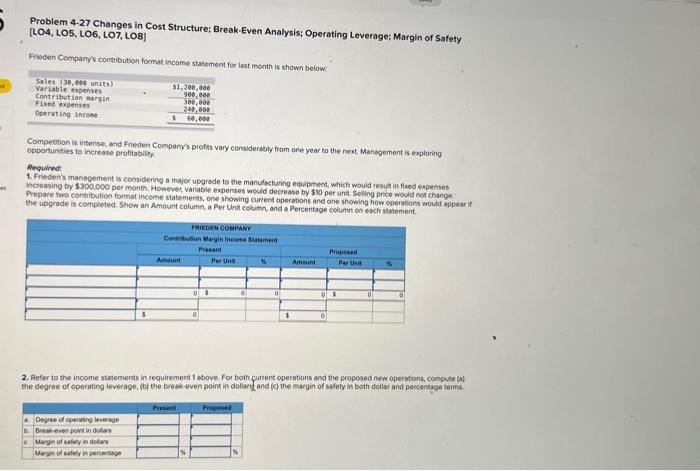

Question: Problem 4-27 Changes in Cost Structure; Break-Even Analysis; Operating Leverage; Margin of Safety [LO4, LO5, LO6, LO7, LO8] Frbeden Company's contribution format income statement for

![of Safety [LO4, LO5, LO6, LO7, LO8] Frbeden Company's contribution format income](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fc1fd0b3852_24866fc1fd055af2.jpg)

Problem 4-27 Changes in Cost Structure; Break-Even Analysis; Operating Leverage; Margin of Safety [LO4, LO5, LO6, LO7, LO8] Frbeden Company's contribution format income statement for last month is shown below Competrion is intense, and Frieden Company's profits vary considerably from one year to the next. Manejement is exploring opportunities to increase profitability. Required: 1. Fileden's manogement is considering a major upgrade to the manulsturing equipment, which would resul in fised expenses increasing by $300,000 per month. Howevet, variable expenses would docrease by $10 per unit $ boling prico would not change. Prepore two coneribution format income statements, one showing current operetions and ane showing how eperabons would appear if the upgrade is completed. Show an Amount column, a Per Unit column and a Percentage column on exch satement. 2. Refer to the income statements in requirement 1 above. For both current operations and the proposed new operations, compute (a) the degree of operating leverage, (b) the break-even point in dollarg and (c) the margin of safety in both dollar and percectage tems. 3-a. Calculate the unit sales per month at which Frieden management will be indifferent between doing the major upgrade to the manufacturing equipment and not doing the upgrade. 3-b. Based on the above analysis, should Frieden proceed with the major upgrade? Yes No 3-c. Why or why not? 1-a. Refer to the original data. instead of doing the major upgrade tghe equipment, management is considering introducing a new idvertising campaign thet will increase fixed expenses by $25,000 per month. Manapement believes the new advertisemeats will crease monthily unit sales by 10x. in this case what would be imapact on operating income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts