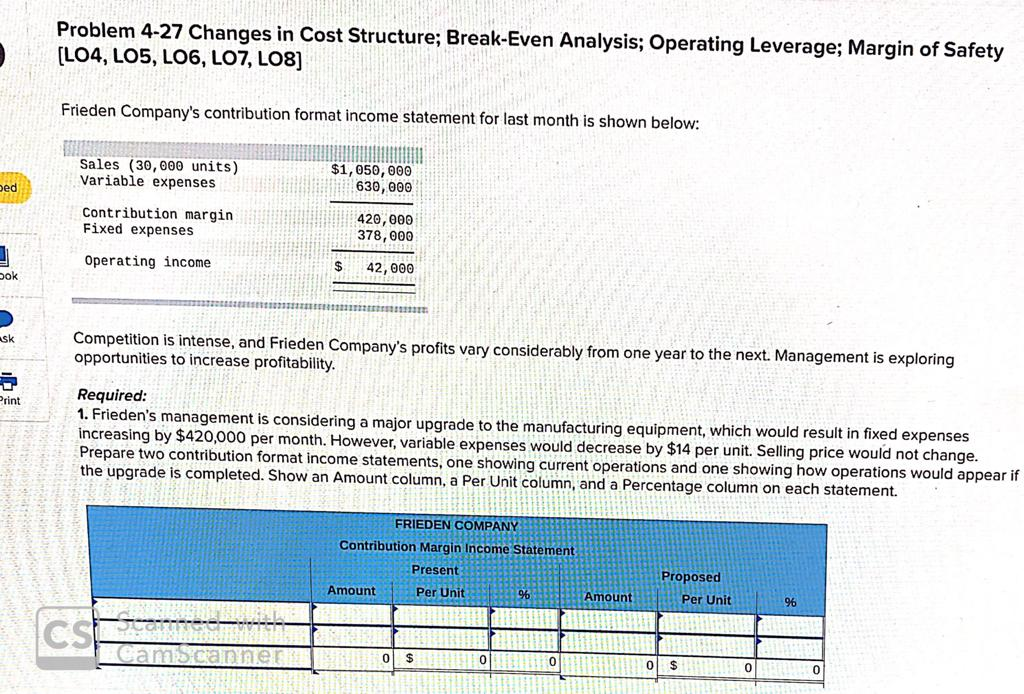

Question: Problem 4-27 Changes in Cost Structure; Break-Even Analysis; Operating Leverage; Margin of Safety [LO4, LOS, LOO, LOT, LO8] Frieden Company's contribution format income statement for

![of Safety [LO4, LOS, LOO, LOT, LO8] Frieden Company's contribution format income](https://s3.amazonaws.com/si.experts.images/answers/2024/07/669a745d532a1_364669a745c8f523.jpg)

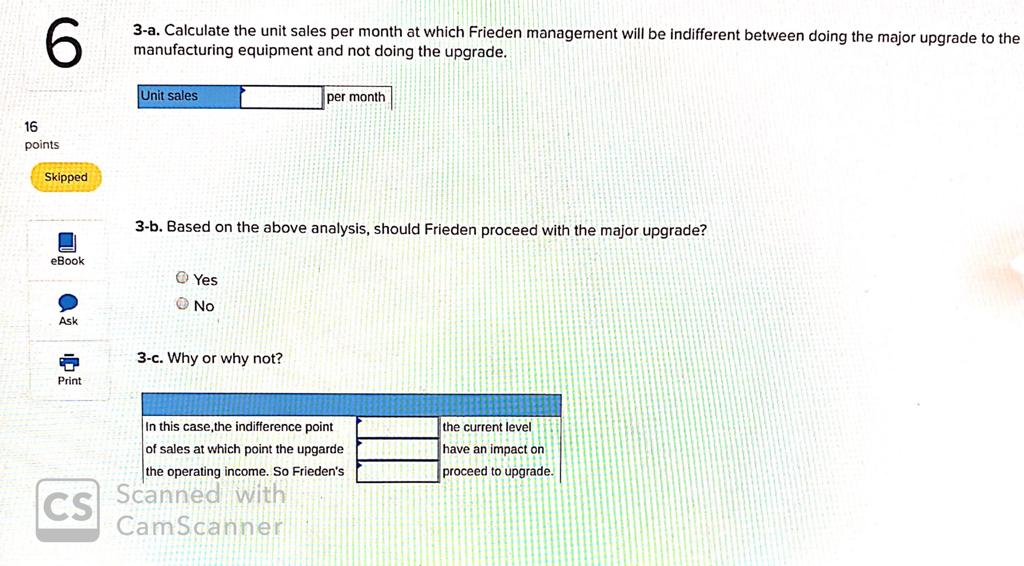

Problem 4-27 Changes in Cost Structure; Break-Even Analysis; Operating Leverage; Margin of Safety [LO4, LOS, LOO, LOT, LO8] Frieden Company's contribution format income statement for last month is shown below: Sales (30,000 units) Variable expenses $1,050,000 630,000 Contribution margin Fixed expenses 420,000 378,000 Operating income 42.000 bok Ask Competition is intense, and Frieden Company's profits vary considerably from one year to the next. Management is exploring opportunities to increase profitability. Print Required: 1. Frieden's management is considering a major upgrade to the manufacturing equipment, which would result in fixed expenses increasing by $420,000 per month. However, variable expenses would decrease by $14 per unit. Selling price would not change. Prepare two contribution format income statements, one showing current operations and one showing how operations would appear if the upgrade is completed. Show an Amount column, a Per Unit column, and a Percentage column on each statement. FRIEDEN COMPANY Contribution Margin Income Sta Present Proposed Per Unit Amount Per Unit nount 96 Cams canner TERROR Required: 1. Frieden's management is considering a major upgrade to the manufacturing equipment, which would result in fixed expenses increasing by $420,000 per month. However, variable expenses would decrease by $14 per unit. Selling price would not change. Prepare two contribution format income statements, one showing current operations and one showing how operations would appear if the upgrade is completed. Show an Amount column, a Per Unit column, and a Percentage column on each statement. oints Skipped FRIEDEN COMPANY Contribution Margin Income Statement Present Amount Per Unit Amount Proposed Per Unit eBook 0 $ 0 0 Ask $ 0 $ Print 2. Refer to the income statements in requirement 1 above. For both current operations and the proposed new operations, compute (a) the degree of operating leverage, (b) the break-even point in dollars, and (c) the margin of safety in both dollar and percentage terms. Present Proposed a. Degree of operating leverage b. Break-even point in dollars c Margin of safety in dollars Margin of safety in percentage CamScanner % % 3-a. Calculate the unit sales per month at which Frieden management will be indifferent between doing the major upgrade to the manufacturing equipment and not doing the upgrade. Unit sales per month 16 points Skipped 3-b. Based on the above analysis, should Frieden proceed with the major upgrade? eBook Yes No 3-c. Why or why not? Print the current level have an impact on proceed to upgrade. In this case, the indifference point of sales at which point the upgarde the operating income. So Frieden's Scanned with CamScal Skipped 4-a. Refer to the original data. Instead of doing the major upgrade to the equipment, management is considering introducing a new advertising campaign that will increase fixed expenses by $50,000 per month. Management believes the new advertisements will increase monthly unit sales by 20%. In this case what would be imapact on operating income. eBook Operating income Ask Print 4-b. Should Frieden proceed with the new advertising So yes ned with CONO Scanner

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts