Question: Problem 4-28 Valuing free cash flow Phoenix Corp. faltered in the recent recession but is recovering. Free cash flow has grown rapidly Forecasts made at

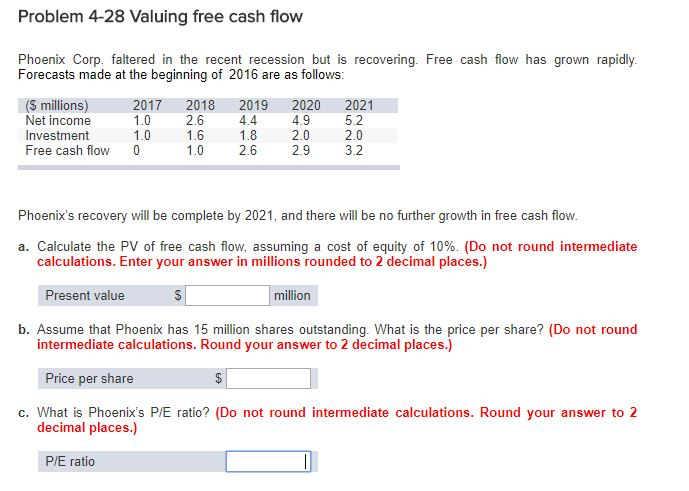

Problem 4-28 Valuing free cash flow Phoenix Corp. faltered in the recent recession but is recovering. Free cash flow has grown rapidly Forecasts made at the beginning of 2016 are as follows (S millions) 2017 2018 2019 2020 2021 1.0 4.9 Net income Investment Free cash fioW 5.2 1.0 1.6 1.8 2.02.0 1.0 2.6 2.9 3.2 2.6 Phoenix's recovery will be complete by 2021, and there will be no further growth in free cash flow a. Calculate the PV of free cash flow, assuming a cost of equity of 10%. (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Present value million b. Assume that Phoenix has 15 million shares outstanding. What is the price per share? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Price per share c. What is Phoenix's P/E ratio? (Do not round intermediate calculations. Round your answer to 2 decimal places.) P/E ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts