Question: PROBLEM 4-29 and PROBLEM 4-32 Problem 4-29 (AICPA Adapted) c. 5,000, d. 9,500,000 Company seeking P1,900,000 damages for patent In May 2020, Caso Company filed

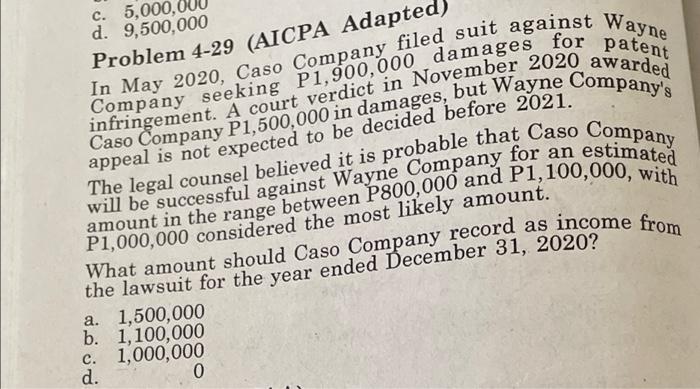

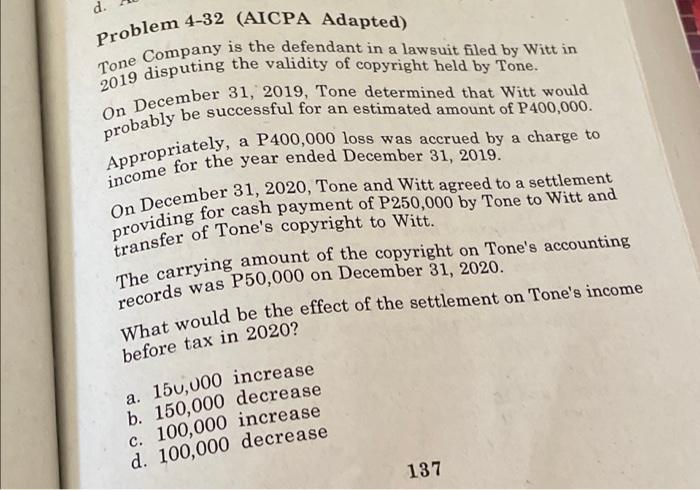

Problem 4-29 (AICPA Adapted) c. 5,000, d. 9,500,000 Company seeking P1,900,000 damages for patent In May 2020, Caso Company filed suit against Wayne infringement. A court verdict in November 2020 awarded Caso Company P1,500,000 in damages, but Wayne Company's appeal is not expected to be decided before 2021. will be successful against Wayne Company for an estimated The legal counsel believed it is probable that Caso Company amount in the range between P800,000 and P1,100,000, with P1,000,000 considered the most likely amount. What amount should Caso Company record as income from the lawsuit for the year ended December 31, 2020? a. 1,500,000 b. 1,100,000 c. 1,000,000 d. 0 d. Problem 4-32 (AICPA Adapted) Tone Company is the defendant in a lawsuit filed by Witt in 2019 disputing the validity of copyright held by Tone. On December 31, 2019, Tone determined that Witt would probably be successful for an estimated amount of P400,000. Appropriately, a P400,000 loss was accrued by a charge to income for the year ended December 31, 2019. On December 31, 2020, Tone and Witt agreed to a settlement providing for cash payment of P250,000 by Tone to Witt and transfer of Tone's copyright to Witt. The carrying amount of the copyright on Tone's accounting on December 31, 2020. records was P50,000 What would be the effect of the settlement on Tone's income before tax in 2020? a. 150,000 increase b. 150,000 decrease c. 100,000 increase d. 100,000 decrease 137

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts