Question: Problem 4-33 (LO. 1, 3) Ann and Bob form Robin Corporation. Ann transfers property worth $420,000 (basis of $150.000) for 20 shares in Robin Corporation.

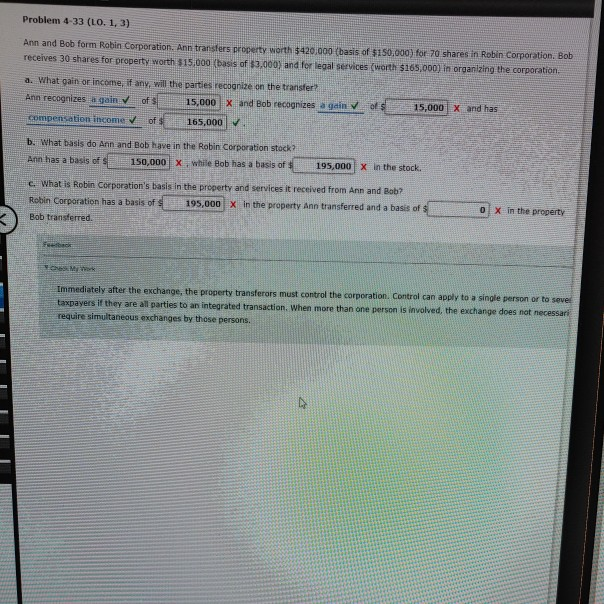

Problem 4-33 (LO. 1, 3) Ann and Bob form Robin Corporation. Ann transfers property worth $420,000 (basis of $150.000) for 20 shares in Robin Corporation. Bob receives 30 shares for property worth $15,000 (basis of $3,000) and for legal services (worth $165,000) in organizing the corporation. a. What gain or income, if any, will the parties recognize on the transfer? Ann recognizes pain of 1 5,000 X and Bob recognizes again compensation income of 165,000 of 15,000 X and has b. What basis do Ann and Bob have in the Robin Corporation stock? Ann has a basis of 150,000 x, while Bob has a basis of $ 195,000 x in the stock. e. What is Robin Corporation's basis in the property and services it received from Ann and Bob? Robin Corporation has a basis of $ 195,000 X in the property Ann transferred and a basis of $ Bob transferred. 0 x in the property Immediately after the exchange, the property transferors must control the corporation Control can apply to a single person or to sever taxpayers if they are all parties to an integrated transaction. When more than one person is involved, the exchange does not necessari require simultaneous exchanges by these persons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts